Real Story

EXERCISE YOUR RIGHT AGAINST BIR HARASSMENT AND OPPRESSION.

Contact us through

emsm@kataxpayer.com

0908 880 7568 and katax.jocelyn@gmail.com

0917 307 1356 and katax.onia@gmail.com

0922 801 0922 c/o ETM Tax Agent Office

0917 307 1316 and katax.guia@gmail.com

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

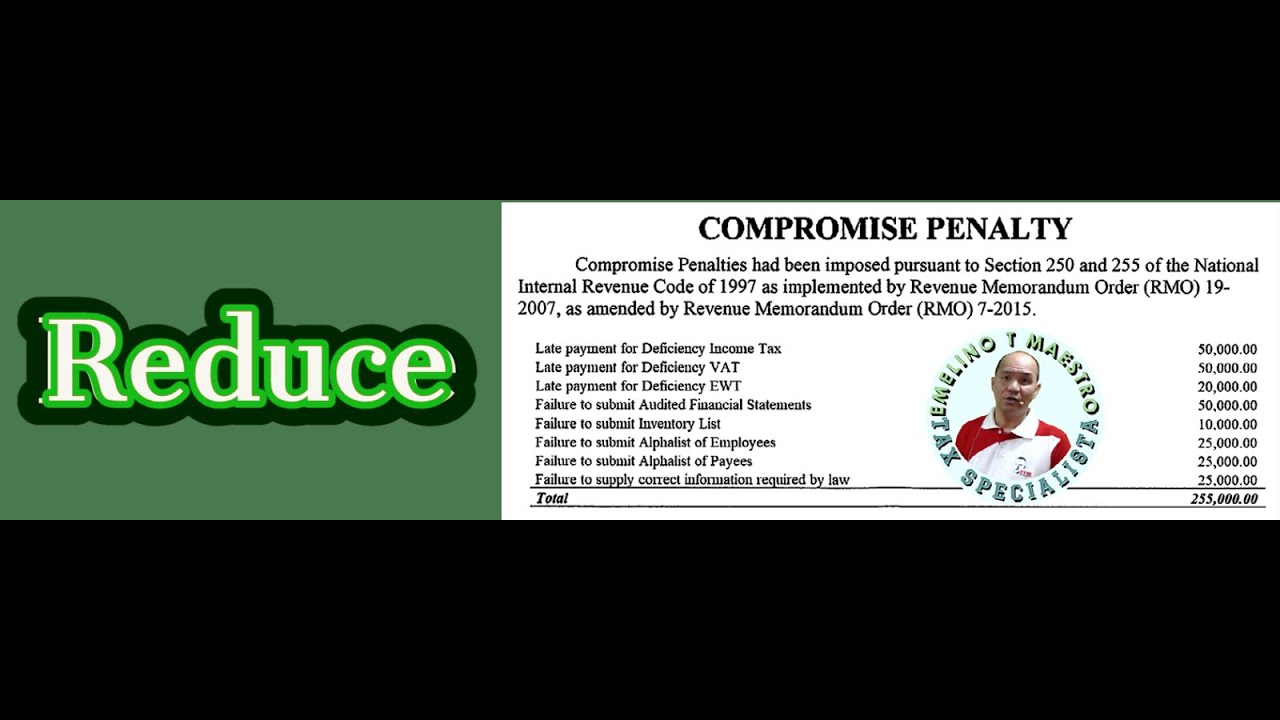

Together we can REDUCE an assessment United we can STOP the harassment

Visit our websites:

https://emelinotmaestro.com/

https://kataxpayer.com/

https://taxspecialista.legal/

Like, Subscribe, and Follow us on Social Media:

TaxSpecialista YouTube Channel: https://www.youtube.com/c/EmelinoTMaestro

Kataxpayer Facebook Fan Page: https://www.facebook.com/KATAXPAYER

TaxSpecialista Discord Server: https://discord.gg/GPAyVD5ATu

FREE BOOK _ https://drive.google.com/file/....d/1eHZZaVUdkS62-1HQG

GO TO KATAXPAYER FACEBOOK _ https://facebook.com/becomesupporter/KATAXPAYER/

JOIN TAX SPECIALISTA _ https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

Taxpayer Ako! Movement (Application Form)

Click this now https://forms.gle/dRVJ8es3hrcH7UEv6

Tax Bookkeeper (Application Form)

Click this https://forms.gle/tbb46Wm2sDmjiBDu5

#ItanongMunaKayMaestro

#TotoongTaxSpecialista

#EmelinoTMaestro

#Kataxpayer

#EaseOfPayingTaxes

#BIRLetterOfAuthority

#BIRNoticeOfDiscrepancy

#BIRPreliminaryAssessmentNotice

#BIRFormalLetterOfDemand

#BIRAssessmentNotice

#BIRSupoenaDucesTecum

#BIRFinalDecisionOnDisputedAssessment

This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

THIS PRIVILEGED COMMUNICATION is from Mr Emelino T Maestro and his associates and partners' beliefs and conviction.

EXERCISE YOUR RIGHT AGAINST BIR HARASSMENT AND OPPRESSION.

Contact us through

0919 892 2399 and emsm@kataxpayer.com

0908 880 7568 and katax.jocelyn@gmail.com

0917 307 1356 and katax.onia@gmail.com

0922 801 0922 c/o ETM Tax Agent Office

0917 307 1316 and katax.guia@gmail.com

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

Together we can REDUCE an assessment United we can STOP the harassment

Visit our websites:

https://emelinotmaestro.com/

https://kataxpayer.com/

https://taxspecialista.legal/

Like, Subscribe, and Follow us on Social Media:

TaxSpecialista YouTube Channel: https://www.youtube.com/c/EmelinoTMaestro

Kataxpayer Facebook Fan Page: https://www.facebook.com/KATAXPAYER

TaxSpecialista Discord Server: https://discord.gg/GPAyVD5ATu

FREE BOOK _ https://drive.google.com/file/....d/1eHZZaVUdkS62-1HQG

GO TO KATAXPAYER FACEBOOK _ https://facebook.com/becomesupporter/KATAXPAYER/

JOIN TAX SPECIALISTA _ https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

Taxpayer Ako! Movement (Application Form)

Click this now https://forms.gle/dRVJ8es3hrcH7UEv6

Tax Bookkeeper (Application Form)

Click this https://forms.gle/tbb46Wm2sDmjiBDu5

#ItanongMunaKayMaestro

#TotoongTaxSpecialista

#EmelinoTMaestro

#Kataxpayer

#EaseOfPayingTaxes

#BIRLetterOfAuthority

#BIRNoticeOfDiscrepancy

#BIRPreliminaryAssessmentNotice

#BIRFormalLetterOfDemand

#BIRAssessmentNotice

#BIRSupoenaDucesTecum

#BIRFinalDecisionOnDisputedAssessment

This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

THIS PRIVILEGED COMMUNICATION is from Mr Emelino T Maestro and his associates and partners' beliefs and conviction.

HOW TO ACCOMPLISH BIR FORM 1701Q CORRECTLY FOR THE QUARTERS ENDING MARCH 31, JUNE 30 AND SEPTEMBER 30.

(DISCLAIMER: THE FOLLOWING PROMO BELOW HAS ALREADY ENDED)

TO GET 100% DISCOUNT COUPON TO WATCH FOR FREE THE 12 VIDEOS STATED IN THIS VIDEO, PLEASE PLACE YOUR EMAIL ADDRESS BELOW AND THE LINK OF THIS VIDEO SHALL BE EMAILED TO YOUR FRIENDS WHO MAY BE AN ACCOUNTANT, BOOKKEEPER, Certified Public Accountant, lawyer and businessperson in total of 10 pax copy furnished my email address TaxMappingApps@gmail.com.. For 1701Q tutorial videos, please go to PATREON.COM/EMELINOTMAESTRO today.

To get the 12 videos that discuss the proper accomplishment of BIR Form No. 1701Q for three quarters and for 4 types of business scenarios, please follow carefully the instructions presented in this video. Else, you would receive nothing.

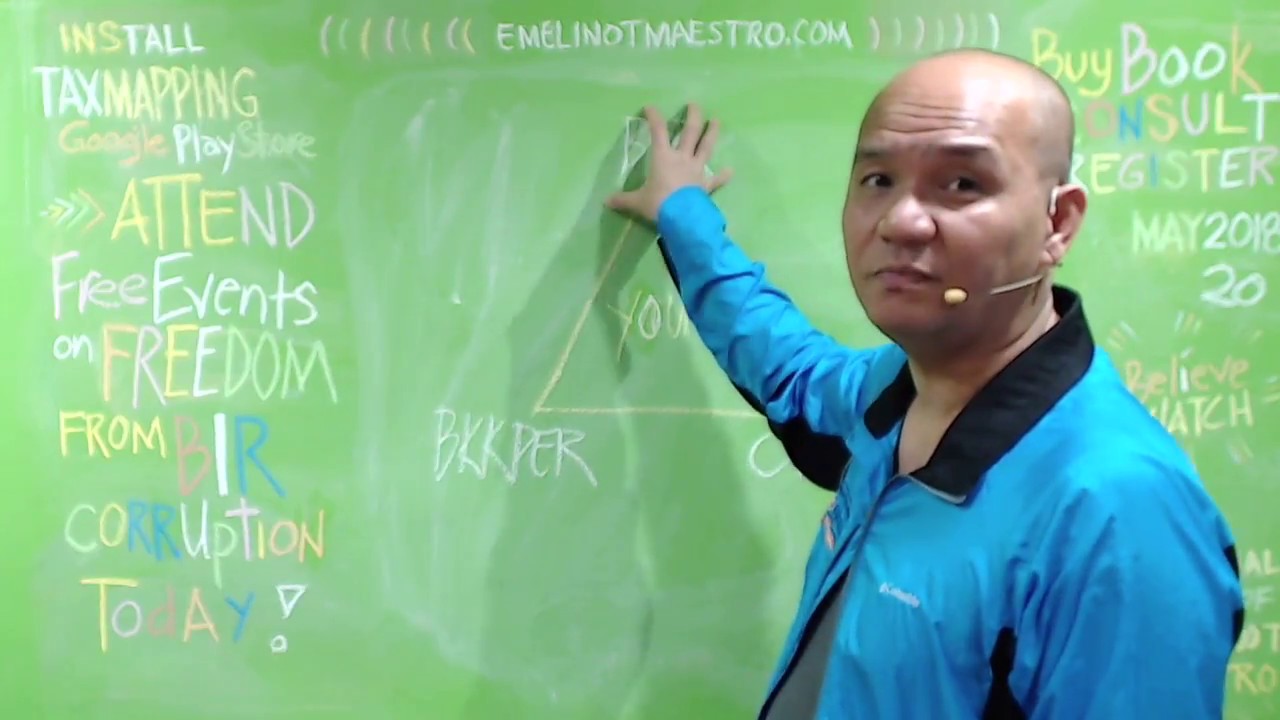

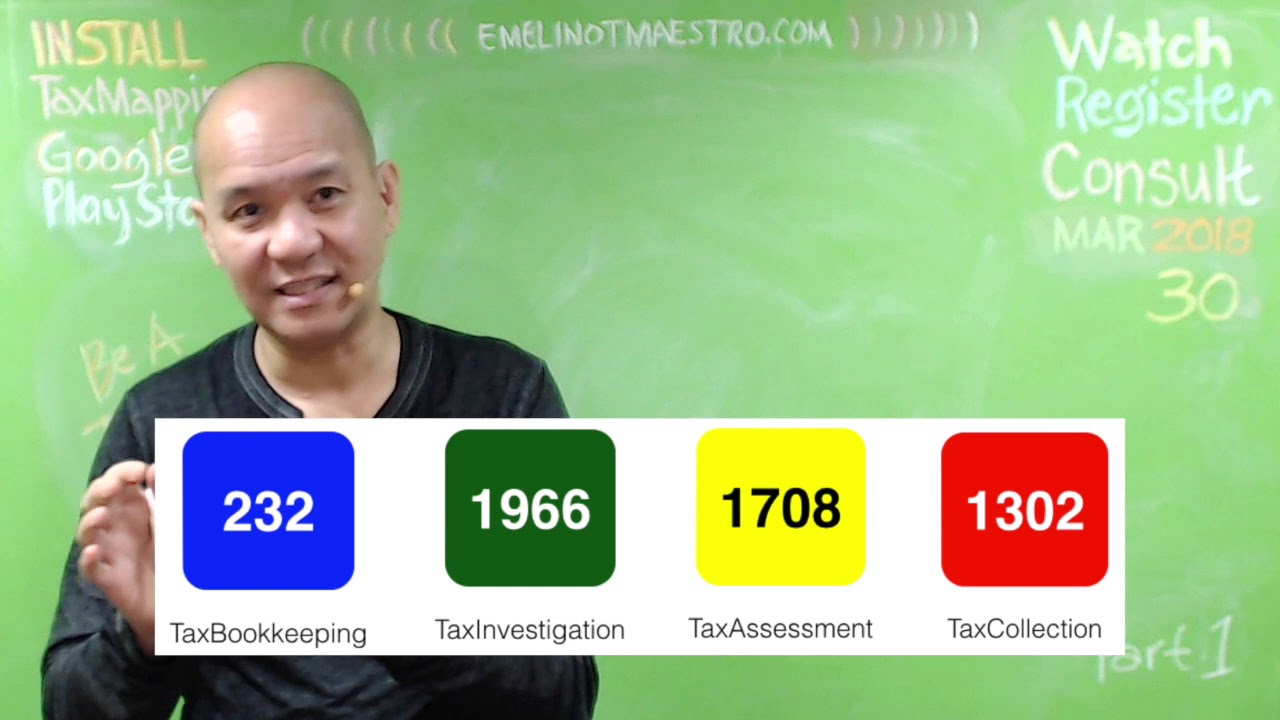

Business conferences and orientations for those who wanted to be a Tax Specialista on the following areas

1. Estate Tax and Inheritance Problems Specialista

2. BIR Tax Mapping Specialista

3. BIR Oplan Kandado Specialista

4. BIR Letter of Authority Specialista

5. BIR Open Case Specialista

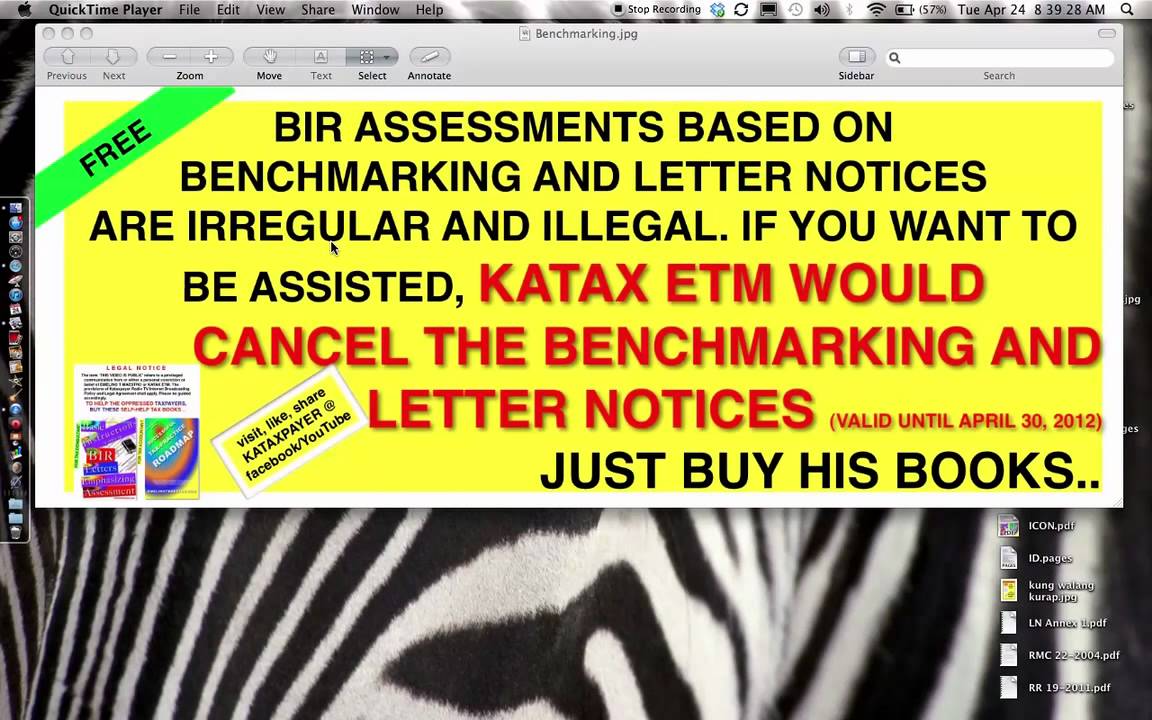

6. BIR Benchmarking Specialista

7. BIR Subpeona Duces Tecum Specialista

8. BIR Letter of Authority Specialista

will be held monthly subject to change without notice and obligation. Study now and mentor me now, Pay ETM later Plan is accessible and available.

You don't have to resign to your present job to be a Tax Specialista. If you don't have a business address, ETM will provide one business address for you. Please install Tax Mapping App via Google Play Store. This offer is valid to all interested Filipinos such as accountants, bookkeepers, financial advisers, property consultants, real estate consultants, engineers, doctors, skilled workers, OFWs, CPAs, lawyers, nurses, auditors and many more. Please call ETM at 02-9216107, 0917-3071316 and 0917-3071356

SUBSCRIBE PLEASE AND FOLLOW MY KATAXPAYER FACEBOOK ACCOUNT

BIR Form 1701Q - Quarterly Income Tax Return

Guidelines and Instructions

Who Shall File

This return shall be filed in triplicate by the following individuals

regardless of amount of gross income:

1) A resident citizen engaged in trade, business, or practice of

profession within and without the Philippines.

2) A resident alien, non-resident citizen or non-resident alien

individual engaged in trade, business or practice of profession

within the Philippines.

3) A trustee of a trust, guardian of a minor, executor/administrator

of an estate, or any person acting in any fiduciary capacity for any

person, where such trust, estate, minor, or person is engaged in

trade or business.

An individual whose sole income has been subjected to final

withholding tax, or who is exempt from income tax pursuant to the Tax Code and other laws, is not required to file an income tax return.

Married individuals shall file a return for the taxable year to include the income of both spouses, computing separately their individual income tax based on their respective total taxable income. Where it is impracticable for the spouses to file one return, each spouse may file a separate return of income. If any income cannot be definitely attributed to or identified as income exclusively earned or realized by either of the spouses, the same shall be divided equally between the spouses for the purpose of determining their respective taxable income.

The income of unmarried minors derived from property received from a living parent shall be included in the return of the parent except (1) when the donor’s tax has been paid on such property, or (2) when the transfer of such property is exempt from donor’s tax.

If the taxpayer is unable to make his own return, the return may be

made by his duly authorized agent or representative or by the guardian or other person charged with the care of his person or property, the principal and his representative or guardian assuming the responsibility of making the return and incurring penalties provided for erroneous, false or fraudulent returns.

Compensation income need not be reported in the Quarterly Income

Tax Return. The same shall be reported in the Annual Income Tax Return

only.

Call 09173071316 or 09088807568

As a democratic nation, every Filipino is entitled to due process as enshrined in Section 1, Article III of the 1987 Philippine Constitution.

When a motorist is pulled over by an enforcer for a traffic violation, he has the right to clarify or dispute the alleged violation. In a criminal case, a suspect is presumed innocent, unless proven guilty beyond reasonable doubt.

There is also due process in tax assessments.

Taxation is the lifeblood of the government as it funds the needs of its citizenry in terms of public infrastructure, education, law and order, and food security. The Bureau of Internal Revenue (BIR), the government’s main tax agency, was assigned a P1.8 trillion tax collection target this year. Based on news reports, the BIR’s total revenue take for the first nine months amounted to P1.3 trillion, up by 10.8% from the same period last year. This means that the BIR needs to collect P500 billion taxes during the remaining three months of the year to meet its target. This is a tall order considering that the “ber” months are also normally the “lean” months.

To meet this gargantuan task, one can expect the BIR to pursue a more aggressive approach in collecting taxes. But in carrying out its mandate, the BIR must respect the rights of taxpayers, such as in faithfully observing the taxpayer’s right to substantive and procedural due process during a tax investigation.

An assessment is formalized through the issuance of the formal assessment notice (FAN), which must be protested within 30 days from its receipt. Otherwise, the FAN shall become final and executory. The BIR can then enforce collection by issuing a warrant of distraint/garnishment.

However, for an assessment to be valid, the corresponding assessment notice must be properly served and received by the taxpayer. This is in accordance with Section 228 of the National Internal Revenue Code, which provides that the taxpayer shall be informed in writing of the law and the facts on which the assessment is made; otherwise, the assessment shall be void. The assessment regulations (i.e., Revenue Regulations No. 12-99) explicitly require “the written details on the nature, factual and legal bases of the deficiency tax assessments.”

In a July 24, 2017 case docketed as CTA EB Case No. 1444, the Court of Tax Appeals (CTA) struck down a deficiency tax assessment on the basis that the taxpayer did not receive the assessment notice. In the said case, the taxpayer did not get the assessment notice since it was addressed and delivered to the taxpayer’s old address. Under existing jurisprudence, in case of denial of receipt of the assessment notice by the taxpayer, the BIR has the burden to prove that such assessment was indeed received by the taxpayer. In this case, the court noted that the BIR failed to prove that the taxpayer had received the assessment notice.

Citing a Supreme Court decision, the CTA stated that if the BIR was already aware of the new location of the taxpayer, even in the absence of any formal application for change of address, it cannot simply pretend lack of knowledge of the change of address and is bound to send any issuance/notice to the taxpayer’s new location. Without receipt of the assessment notice, the Court ruled that the taxpayer was deprived of due process as required under Section 228 of the Tax Code. Consequently, the assessment is deemed null and void.

Finally, the CTA declared the issued Warrant of Garnishment as illegal, on the strength of the Supreme Court ruling, that “a void assessment bears no valid fruit.”

The CTA decision, in this case, reminds us of the importance of due process, particularly in the proper service of an assessment notice. Compliance with the requirements of Section 228 of the Tax Code is not merely a matter of formality; it is a mandatory substantive requirement. The precepts of due process dictates that every taxpayer must be accorded the opportunity to produce evidence on its behalf based on the factual and legal grounds indicated on the assessment notice.

However, to invoke the right to due process, the taxpayer is also expected to come forward with clean hands. It is incumbent on the taxpayer to inform the BIR of the change in its address so that the assessment notice can be served accordingly. Failure to inform or update such information would mean that the data on the BIR’s official record is presumed to be correct. Relying on the taxpayer’s representation, the BIR’s mailing of notice based on the address on record would then be considered regular and binding on the taxpayer.

Our Civil Code provides that “Ignorance of the law excuses no one from compliance therewith.” So let’s know our tax laws and regulations (or at least be properly counseled), so we can exercise our taxpayer rights, which includes the right to due process (and of course, not lose a case due to a mere technicality). (from PwC)

National Government Agencies (NGAs). National Government Agencies (NGAs) - Manual · Download. Details. National Government Agencies (NGAs) - Volume I · Download. Details. National Government Agencies (NGAs) - Volume II · Download. Details. National Government Agencies (NGAs) - Volume III · Download.The Government Accounting Manual (GAM) for National Government. Agencies (NGAs) is a product of hard work and selfless commitment of the working group composed of the heads of the services and selected personnel of the. Government Accountancy Sector (GAS), Commission on Audit (COA) with ... Introduction. Accounting is an effective tool of management in evaluating the performance of the different agencies of government. The performance of the public managers would depend at most, on financial reports generated by the use of accounting systems. Cognizant of this need, a new accounting ...Annex Number, Description, Unit. 1, General Journal, Sheet. 2, Cash Receipts Journal, Sheet. 3, Check Disbursements Journal, Sheet. 4, Cash Disbursements Journal, Sheet. 5, General Ledger, Sheet. 6, Subsidiary Ledger, Sheet. 7, Supplies Ledger Card, Sheet. 8, Work, Other Animals And Breeding Stocks Ledger Card ...a) Permanently bound books of accounts for registration/stamping or the bound journals and/or ledgers; b) Proof of Payment of Annual Registration Fee (BIR Form 0605) – current year. b) Present the manual books of accounts for Stamping and registration purposes. This record is called a “book of accounts”, aptly named since it is literally a record of your operations. It is also a convenient means to see the results of your daily business transactions. The BIR will require you to register your book of accounts when you apply for a certificate of registration.All business establishments and taxpayers are required to keep a record of their day to day business transactions in order to know the result of their operations. The said record is referred to as “book of accounts”. Whenever a business establishment or taxpayer applies for certificate of registration (COR) with the BIR, it also ...All business establishments registered with the Bureau of Internal Revenue (BIR) are required to maintain and keep a record of their day to day transactions. Such record is referred to as “books of accounts” or “accounting books”. In general, the accounting books being registered to the BIR depends on the nature and size ...For someone like a business owner or a taxpayer, one of the most important requirements that you need to comply with the BIR (Bureau of Internal Revenue) is to maintain a record of day-to-day business transactions called book of accounts, which should be registered once you apply for a certificate of registration, and ...

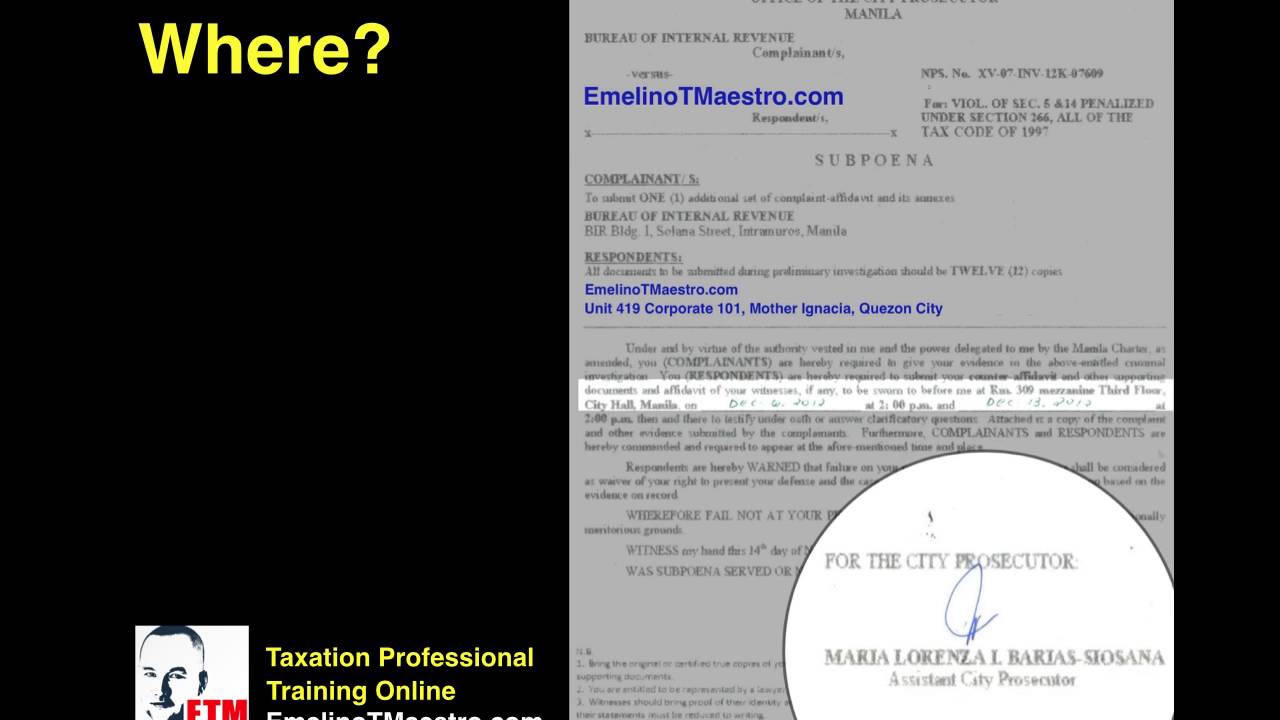

ETM discussed in this video the career and business opportunities that RA 11213 (2019 Tax Amnesty) brings, the 3 purposes that the DOJ Prosecutors should bear in mind when a BIR filed a Complaint Affidavit due to failure to obey the BIR Subpoena Duces Tecum and Why GAAP&PFRS and business accounting (managerial accounting) is not to be used in the financial statements to be submitted to the BIR for the taxable year 2018 and succeeding year (Legal Basis and jurisprudence involved)..... IMPORTANT: Those who are not qualified to avail the 2019 Tax Amnesty due to the fact that the President vetoed the 2019 GENERAL TAX AMNESTY are INVITED TO ATTEND THE ONE TIME AND EXCLUSIVE TRAINING WITH EMELINO T MAESTRO who will reveal to them the SECRETS BEHIND RA 11213... See you at Sofitel... Feb 28, 2019...2pm ... 20k plus VAT is the INVESTMENT FEE to be paid immediately... Thanks

Online Live Program: TAX SPECIALISTA ONLINE UNIVERSITY

Tagline; Making Tax Opportunities Accessible"

Time: Starts 7am from Monday to Friday

Venue: Kataxpayer Facebook and EmelinoTMaestro YouTube Channel

CONTACT DETAILS:

1. EmelinoTMaestro.com

2. 0917(307)1316

3. 0917(307)1356

4. 0908(880)7568

5. 0939(905)2638

6. DonateMoreNow@gmail.com

HOW TO DONATE TO NEGOSYO MUNA. PUHUNAN LATER: Business Opportunity Project

Please click this link "https://taxspecialista.blogspot.com/2019/02/donatemorenow-emelinotmaestro-negosyo.html"

HIRING

'Tax Specialista" (No Experience Required, Start Immediately.)

ETM will be your Mentor and Coach...

DOWNLOAD from Google Play Store.

TAX MAPPING App

(If you want to get a professional service

from a Tax Specialista)

THIS PRIVILEGED VIDEO IS

FROM THE PERSONAL CONVICTION

AND PURE BELIEF OF EMELINO T MAESTRO.

Thank you for not disseminating and viewing this video.

Thank you very much to those who watched and shared this video

Call 09173071316 or 09088807568

Pursuant to Section 244, in relation to Sections 6 and 204, and other pertinent provisions of the National Internal Revenue Code (NIRC) of 1997, as amended, these Regulations are hereby promulgated to provide for the policies, procedures, and guidelines in the implementation of Voluntary Assessment and Payment Program (VAPP) for the collection of additional tax revenues, which could otherwise be collected through audit and enforcement effort. Any person, natural or juridical, including estates and trusts, liable to pay internal revenue taxes for the above specified period/s who, due to inadvertence or otherwise, erroneously paid his/its internal revenue tax liabilities or failed to file tax returns/pay

taxes, of the

may avail of the benefits under these Regulations, except those falling under any following instances:

Those taxpayers who have already been issued a Final Assessment Notice (FAN) that have become final and executory, on or before the effectivity of these Regulations;

Persons under investigation as a result of verified information filed by a Tax Informer under Section 282 of the NIRC of 1997, as amended, with respect to the deficiency taxes that may be due out of such verified information;

Those with cases involving tax fraud filed and pending in the Department of Justice or in the courts; and

Those with pending cases involving tax evasion and other criminal offenses under Chapter II of Title X of the NIRC of 1997, as amended. The voluntary payment, as indicated in the BIR Form No. 0622 (Payment Form), should be in cash as a condition to avail of the privilege under these Regulations. Hence, non- cash modes of payment, such as Tax Debit Memo and the like, will not qualify as a valid payment. The duly accomplished BIR Form No. 0622 shall be presented for payment to any BIR Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) under the LT Office/RDO having jurisdiction over the taxpayer, except for ONETT involving the sale of property which must be filed/paid with AABs/RCOs under the RDO covering the location of the property. Hence, separate applications must be filed in case the availment is under non-ONETT (Sections 9.a and 9.b) and ONETT wherein the same taxpayer is registered in an RDO different from the RDO having jurisdiction over the place where the decedent is domiciled at the time of death; or where the donor is domiciled at the time of donation; or where the property is located. Likewise, separate applications must be filed for availment under Section 9.c for transactions involving the sale of real properties under the jurisdiction of different RDOs.

Taxpayers whose availment is found to be invalid, deficient or defective are not entitled to the privilege under these Regulations. However, they may apply the voluntary payments made against any deficiency tax liability for the taxable year 2018, in case of audit/investigation. Non- submission or submission of erroneous/incomplete/falsified information concerning the VAPP shall not entitle the taxpayer to avail of the privilege under these Regulations. Still, the voluntary payment may be applied against any deficiency tax liability for the taxable year 2018, in case of audit/investigation.In cases where any non-ONETT tax deficiency covering the taxable period under Section 3 has already been paid, the basic deficiency tax paid shall be added to the tax due of the applicable tax returns for 2018 in computing the amount of voluntary payment required under Section 9.a. provided, that, such payment did not arise from the cases excluded from the coverage of the VAPP under Section 3. The amount to be paid must be the higher amount in column B, but in no case should be less than the amount in column C. Total taxes due in 2017 and 2018, for purposes of the above schedule refer to the sum of all tax due per tax return (IT, PT, ET, and DST) and net VAT payable (VAT) before deducting any creditable withholding tax, quarterly payment or advance payment. Gross sales and taxable net income shall be based on the Annual Income Tax Return for the taxable year ending December 31, 2018, and fiscal year 2018, ending on the last day of July 2018 to June 2019. A Certificate of Availment (Annex C) shall be issued by the concerned LT Office/RDO within three (3) working days from approval of the application. Such Certificate shall serve as proof of the taxpayer’s availment of the VAPP, compliance with the requirements, and entitlement to the privilege granted under these Regulations. The LT Office/RDO shall transmit all dockets on approved VAPP applications to the concerned reviewing office not later than the 5th day following the month of issuance of the Certificate of Availment for post review.

Together we REDUCE an assessment United we STOP the harassment

Support our advocacy by joining our YouTube Membership and get access to exclusive perks!

https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

Contact us at:

0908 880 7568 Len

0917 307 1356 Onia

0917 307 1316 Guia

Visit our websites:

https://emelinotmaestro.com/

https://kataxpayer.com/

Like, Subscribe, and Follow us on Social Media:

TaxSpecialista YouTube Channel: https://www.youtube.com/c/EmelinoTMaestro

Kataxpayer Facebook Fan Page: https://www.facebook.com/KATAXPAYER

TaxSpecialista Discord Server: https://discord.gg/GPAyVD5ATu

Support our campaign for the passage and ratification of the General Tax Amnesty. Sign and share this petition now! http://chng.it/Mp7f4z5z

Taxpayer Ako! Movement (Application Form)

Click this now https://forms.gle/dRVJ8es3hrcH7UEv6

Tax Bookkeeper (Application Form)

Click this https://forms.gle/tbb46Wm2sDmjiBDu5

#ItanongMunaKayMaestro

#TotoongTaxSpecialista

#EmelinoTMaestro

#Kataxpayer

#EaseOfPayingTaxes

#BIRLetterOfAuthority

#BIRNoticeOfDiscrepancy

#BIRPreliminaryAssessmentNotice

#BIRFormalLetterOfDemand

#BIRAssessmentNotice

#BIRSupoenaDucesTecum

#BIRFinalDecisionOnDisputedAssessment

This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill up accomplish submit prepare file stor retrieve What is tax return BIR Form 1901 1902 1903 1905 1601C 1601EQ 1601FQ 1603 1701Q 1701 1702Q 1702 2551Q 2550M 2550Q 2000 2200 1800 1801

How to answer resolve prepare comply reduce protest compromise settle correct agree request appeal reinvestigate reconsider negotiate decrease abate petition BIR letter of authority subpoena duces tecum checklist of requirements complaint affidavit notice of discrepancy preliminary final assessment notice formal letter of demand a final decision on disputed assessment NOD PAN FLD FAN FDDA penalty open case business closure failure to file submit BIR form tax return VAT nonVAT sales invoice official receipt VAT summary list of sales purchases importation POS daily sales report failure to supply complete information data late registration books of accounts vAT nonVAT invoice official receipt business failure to pay settle deficiency income tax value-added tax percentage tax documentary stamp tax excise tax withholding tax estate tax

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy importation

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer-generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

How to register update apply activate transfer inactivate renew correct terminate cancel change amend BIR certificate of registration TIN taxpayer identification number tax return BIR Form VAT cooperative corporation single sole proprietorship business employee partnership joint venture estate trust employer address civil status RDO books of accounts commercial invoice VAT nonVAt sales invoice official receipt purchase invoice receipt

How to accounting bookkeep interpret record report explain support VAT nonVAT gross income revenue receipts sales deductible non-deductible expenses capital regular assets goods properties personal commercial bank loans liability cost of sale service goods manufactured sold active passive income bank deposit withdrawal professional fee rental lease depreciation advertising compensation wages allowances de minimis fringe benefits SSS PHIC HDMF third party information insurance optional standard deduction interest research and development taxes license transportation travel government certification local government taxes ordinary allowable itemized deduction non-taxable income subject to final tax vat exempt regular special sale purchase returns allowances discounts

The first and pioneering Computerised Books of Accounts with e-Invoicing BIR-Permit is now ready to be used by Retailers, Contractors, Wholesalers, Professionals, Manufacturers, Restaurants and all kinds of taxpayers such as Cooperatives, Corporations, Partnerships, Sole Proprietors, Joint Ventures, etc, whether VAT or NonVAT registered. RESIBO.PH creates auto-tax accounting entries in your books of accounts such as general journal, subsidiary sales journal, subsidiary purchase journal and general ledger. Your 30-year problem of having no or erroneous accounting entries in your books of accounts is finally over. RESIBO.PH also prepares, issues and emails your official receipt, collection receipt or sale invoice whether such is for VAT, VAT-exempt or Zero-VAT transaction directly to the email account of your buyer, client, consumer or customer. You save time, money, storage and manpower. You may use RESIBO.PH for the taxable year 2018 so that your 2018 annual income tax return will be in accordance with the Supreme Court's ruling in the case of BIR v. Lancaster wherein Lancaster won over the P6,400,000 deficiency tax assessment of the BIR by way of using the tax accounting rules and regulations instead of the GAAP/PFRS that usually brings big deficiency tax assessments. Under the TRAIN LAW (RA 10963) and RMC 29, 2019, taxpayers who will use illegitimate accounting entries will be penalised and the mandatory audit of their respective tax returns will be prioritised (BIR Letter of Authority). The use of RESIBO.PH is FREE OF CHARGE. A privilege that ETM is offering you. Coordinate either to Gie or Yljien, Co-Managers. To start ETM process your request to have your copy, please follow instructions by way of COMMENTING your birthname, company's name/TIN and email account hereunder. Thanks for sharing this wonderful information to all of your friends, suppliers and clients so that everyone is complaint with the Tax Code.... No more BIR audit investigation. No more BIR harassment and oppression.

Online Live Program: TAX SPECIALISTA ONLINE UNIVERSITY

Tagline; Making Tax Opportunities Accessible"

Time: Starts 7am from Monday to Friday

Venue: Kataxpayer Facebook and EmelinoTMaestro YouTube Channel

CONTACT DETAILS:

1. EmelinoTMaestro.com

2. 0917(307)1316

3. 0917(307)1356

4. 0908(880)7568

5. 0939(905)2638

6. DonateMoreNow@gmail.com

HOW TO DONATE TO NEGOSYO MUNA. PUHUNAN LATER: Business Opportunity Project

Please click this link "https://taxspecialista.blogspot.com/2019/02/donatemorenow-emelinotmaestro-negosyo.html"

HIRING

'Tax Specialista" (No Experience Required, Start Immediately.)

ETM will be your Mentor and Coach...

DOWNLOAD from Google Play Store.

TAX MAPPING App

(If you want to get a professional service

from a Tax Specialista)

THIS PRIVILEGED VIDEO IS

FROM THE PERSONAL CONVICTION

AND PURE BELIEF OF EMELINO T MAESTRO.

Thank you for not disseminating and viewing this video.

Thank you very much to those who watched and shared this video

BIR Form 1901 - Application for Registration for Self-Employed and Mixed Income Individuals, Estates and Trusts

a) Permanently bound books of accounts for registration/stamping or the bound journals and/or ledgers;

b) Proof of Payment of Annual Registration Fee (BIR Form 0605) – current year.

a) Submit duly accomplished BIR Form 1901 at the RDO or concerned office under the Large Taxpayer Service having jurisdiction over the place where the head office and branch is located, respectively; and

b) Present the manual books of accounts for Stamping and registration purposes

Newly registered taxpayers shall present the manual books of accounts before use to the RDO or concerned office under the Large Taxpayer Service where the place of business is located for approval and registration.

As a general rule, registration of books of accounts shall be simultaneous with the issuance of Certificate of Registration and approved Authority to Print.

Documentary Requirements

a) Photocopy of the first page of the previously registered books;

b) New bound journals and/or ledgers;

c) Proof of Payment Annual Registration Fee (BIR Form 0605) – current year .

a) Accomplish BIR Form 1905 at the RDO or concerned office under the Large Taxpayer Service having jurisdiction over the place where the head office and branch is located, respectively;

b) Present the manual books of accounts at the RDO or concerned office under the Large Taxpayer Service where the place of business is located for Stamping and registration purposes.

The registration of a new set of manual books of accounts shall only be at the time when the pages of the previously registered books have all been already exhausted, provided, that the portions pertaining to a particular year should be properly labeled or marked by taxpayer. This means that it is not necessary for a taxpayer to register/stamp a new set of manual books of accounts each and every year.

First, the BIR Chief was reluctant to extend the filing of Annual Income Tax Return even if the public health and public safety dictate. He gave the taxpaying public more than what it is asking an extension to other relevant forms and documents. Thank you very much, Bossing BIR Chief. However, he did not touch the amnesty due date for the reason that he has no power and authority to do so. So, he asked the DOF Chief's approval, who signed the RR 5-2020. The enforceability of RR demands the lapse of 15 days from its publication in a newspaper of general circulation. BIR people must act faster. I am confident that the RMC extending the amnesty due date will be released after such 15 days. Please, Filipino taxpayers, do not worry much. Such RMC is due to come.

The RR 5-2020 is my piece of evidence that the BIR Chief has no power to introduce new terms and conditions such as non-acceptance of the STOP-FILER/OPEN CASES' Application for Tax Amnesty. This video explains. Thanks for watching and learning the dangerous tactics of some BIR officials.

More than 180 days from the date when the LoA was issued were wasted. Still, the revenue officers involved exerted no concrete and complete efforts to hold a closing conference prior to the preparation and delivery of the ‘Notice For Informal Conference’.

RAMO 1-2000. Essential to an effective audit of internal revenue tax liabilities is the holding of a closing conference with the taxpayer before the preparation of the Final Report of Investigation by the Revenue Officer assigned to the tax case. During this time, the Revenue Officer and his supervisor explain to the taxpayer how the assessment of his tax liability was arrived at. Necessary time and patience should be devoted to a discussion of any proposed adjustments to ensure that the taxpayer has a proper understanding of the issues. Tact and discretion are required in pointing out errors in books and records in order to avoid discrediting an employee or representative of the taxpayer. If necessary, the records of the case shall be presented to the taxpayer to document the Revenue Officer’s findings. The taxpayer shall then be allowed to examine such records and to present his arguments. If the taxpayer agrees with the audit findings, he shall be made to sign an Agreement Form. If not, the Revenue Officer shall give the taxpayer enough time to document his objections to the proposed assessment.

RR 12-99. Notice for informal conference. – The Revenue Officer who audited the taxpayer’s records shall, among others, state in his report whether or not the taxpayer agrees with his findings that the taxpayers is liable for deficiency tax or taxes. If the taxpayer is not amenable, based on the said Officer’s submitted report of investigation, the taxpayer shall be informed, in writing, by the Revenue District Office or by the Special Investigation Division, as the case may be (in the case Revenue Regional Offices) or by the Chief Division concerned (in the case of the BIR National Office) of the discrepancy or discrepancies in the taxpayer’s payment of his internal revenue taxes, for the purpose of “Informal Conference,” in order to afford the taxpayer with an opportunity to present his side of the case. If the taxpayer fails to respond within fifteen (15) days from date of receipt of the notice for informal conference, he shall be considered in default, in which case, the Revenue District Officer or the Chief of the Special Investigation Division of the Revenue Regional Office, or the Chief of Division in the National Office, as the case may be, shall endorse the case with the least possible delay to the Assessment Division of the Revenue Regional Office or the Commissioner or his duly authorized representative, as the case may be, for appropriate review and issuance of a deficiency tax assessment, if warranted.

It is imperative that the administrative penalty shall be imposed on the revenue officers involved without further hearing and demand thereof.

I culled from the relevant BIR revenue issuances that the penalty for the failure and refusal, and continuing failure and refusal to conduct and conclude an audit investigation is 6-month suspension without pay.

G.R No. 185371. The persuasiveness of the right to due process reaches both substantial and procedural rights and the failure of the CIR to strictly comply with the requirements laid down by law and its own rules is a denial of Metro Stars right to due process. G.R. No. 222743. The ease by which the BIR’s revenue-generating objectives is achieved is no excuse for its non-compliance with the statutory requirement under Section 6 and with its own administrative issuance.

ETM's THREE SECRETS IN HANDLING BIR INITIATED PROBLEMS (1) KNOW THE BIR RULES, (2) ADVERTISE THE KNOWING OF THE BIR RULES, AND (3) APPLY THE BIR RULES Revenue Memorandum Circular No. 31-2016 dated 15 March 2016]

31 March 2016

The Commissioner of Internal Revenue has issued Revenue Memorandum Circular No. 31-2016 dated 15 March 2016 (the "Circular") to circularize the "Entry into Force, Effectivity and Applicability of the Philippines-Turkey Double Taxation Agreement" (the "Tax Treaty") on 11 January 2016.

The Circular states that under Article 28 of the Tax Treaty, the same shall have effect in respect of tax withheld at source on income paid on or after 1 January 2017, and on income in any taxable year beginning on or after 1 January 2017.

In invoking the Tax Treaty, the concerned Turkish resident income earner or his authorized representative should file an Application for Relief for Double Taxation (BIR Form 0901) together with the required documents pursuant to Revenue Memorandum Order 72-2010.Revenue Memorandum Order No. 25-2016 dated 12 June 2016]

15 June 2016

The Commissioner of Internal Revenue has issued Revenue Memorandum Order No. 25-2016 dated 12 June 2016 (the "Order") to supplement the guidelines and procedure in the conduct of investigation on the capacity of parties to acquire properties provided for in Revenue Memorandum Order No. 24-2016.

This Order added a procedure to be undertaken by the One-Time Transactions (ONETT) Team in determining, during the application of Certificate Authorizing Registration and Tax Clearance, the financial capacity of the buyer to acquire the subject property.

Under this Order, if the seller/transferor/assignor is a corporation or is a stranger to the buyer/transferee/assignee of the subject property and it is proven that the latter does not have financial capacity to purchase said property, it shall be presumed that the buyer/transferee/assignee have earned income that was undeclared and the taxes due thereon were unpaid.

In addition to any tax due on the sale/transfer/assignment of the subject property, income taxes shall be assessed against the buyer/transferee/assignee on that amount of consideration for which the latter cannot show proof of financial capacity for, on the taxable year when the sale/transfer/assignment of the subject property occurred.The guidelines and procedure provided under this Order are as follows:

Application for the issuance of Certificate Authorizing Registrations (CARs) and Tax Clearance (TCLs) covering the sale/transfer/assignment of properties under RMO No. 15-2003 and other related issuances shall be evaluated for possible audit or investigation.

Parties to the said transactions may be subjected to an audit or investigation to determine their capacity to hold and/or acquire properties. If the seller/transferor has no capacity over the subject property, the Revenue District Officer (RDO) may recommend the issuance of the electronic Letter of Authority (eLA) for approval of the Regional Director having jurisdiction over the parties concerned.

The One-Time Transactions (ONETT) Team shall undertake the following procedures:

Verify with the Integrated Tax System that the parties regularly file returns and report income sufficient to establish financial capacity.

Individuals not required to file income tax returns (ITRs) shall submit an affidavit stating the reason he/she is not required to file an ITR, his/her total annual income, and source of income, to establish his/her financial capacity.

Presentation of other documents may be necessary to establish financial capacity.

Financial capacity of the buyer to acquire the subject property shall be determined during the application of CARs and TCLs. If proven to have no financial capacity to acquire the property, the transaction is not a sale but a donation subject to donor's tax not CGT.

The lack of financial capacity of the seller/assignor/transferor shall not stop the processing and the issuance of the CARs and TCLs. The ONETT Team may recommend the issuance of eLA.

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

#itanongmunakaymaestro

#totoongtaxspecialista

#emelinotmaestro

#kataxpayer

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill, accomplish BIR Form 1901, 1902, 1903, 1905, 1601C, 1601EQ, 1601FQ, 1603, 1701Q, 1701, 1702Q, 1702, 2551Q, 2550M, 2550Q, 2000, 2200, 1800, 1801, tax returns.

How to prepare valid protest for BIR letter of authority, subpoena duces tecum, checklist of requirements, complaint affidavit, notice of discrepancies, preliminary final assessment notice, formal letter of demand, a final decision on disputed assessment.

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

What is the best thing to do to protect yourself, your family and businesses from outside and unfriendly forces?

Analyses DOJ Resolution BIR subpoena duces tecum failure to submit books accounting record open case

Call 09173071316 or 09088807568

Revised Guidelines on Tax Investigation and

Issuance of Subpoena Duces Tecum

It is the responsibility of the taxpayers to comply with the

requests of the BIR to produce their books of accounts

and/or other records and documents in the course of a tax

investigation and/or access to records requests. Those

who will refuse to produce the requested documents and

records will be dealt with in accordance with these

guidelines.

After ten (10) calendar days from receipt of a Letter of

Authority (LA) and checklist of the requirements for the

audit or access to records request, a First Notice will be

issued to the taxpayer by the revenue officer signed by

himself and/or his group supervisor. If the taxpayer

ignores and continues to disregard the demand for the

submission of the required documents, a Second and

Final Notice signed by the Head of the Office concerned

shall be sent to the taxpayer after ten (10) calendar days

from receipt of the First Notice.

If the First and Second Notice fails to convince the

taxpayer to comply with the requirements the Head of the

Office shall request the issuance of a Subpoena Duces

Tecum (SDT) from the Legal Service of the BIR National

Office, Legal Division of the Regional Office, or any

other authorized office after ten (10) calendar days from

receipt of the Second and Final Notice. The authorized

office shall act on the request for the issuance of SDT

within five (5) calendar days from receipt of such request.

The SDT must be served immediately and the revenue

officer shall return a served copy to the office who issued

the same within five (5) calendar days from issuance

thereof.

Any taxpayer who refuses to comply with the subpoena

duces tecum may be charged of a criminal case against

the taxpayer for violation of Section 5 in relation to

Sections 14 and 266 of the National Internal Revenue

Code and/or may be charged for contempt under Section

3(f), Rule 71 of the Revised Rules of Court.

When there is a request for the dismissal of the cases

filed in court, the BIR shall concur upon payment of ten

thousand pesos (PHP 10,000.00) as penalty for the

delayed compliance and violations of pertinent revenue

regulations and upon submission of the requested

information. The Expanded Senior Citizens Act of 2003 was amended

to further grant our Senior Citizens, aside from the

twenty percent (20%) discount, an entitlement to the

exemption from the value added tax (VAT), if applicable,

for the exclusive use and enjoyment or availment of the

senior citizen on the following:

1. Purchase of medicines, including the purchase of

influenza and pneumococcal vaccines, and such

other essential medical supplies, accessories and

equipment to be determined by the Department of

Health (DOH) xxx;

2. Professional fees of attending physician/s in all

private hospitals, medical facilities, outpatient

clinics and home health care services;

3. Professional fees of licensed professional health

providing home health care services as endorsed

by private hospitals or employed through home

health care employment agencies;

4. Medical and dental services, diagnostic and

laboratory fees in all private hospitals, medical

facilities, outpatient clinics, and home health care

services, in accordance the rules and regulations to

be issued by the DOH, in coordination with

Philhealth;

5. In actual fare for land transportation travel in

public utility buses, public utility jeepneys taxis,

Asian utility vehicles, shuttle services and public

railways, including Light Rail Transit (LRT), Mass Rail

Transit (MRT), and Philippine National Railways

(PNR);

6. In actual transportation fare for domestic air

transport services and sea shipping vessels and the

like, based on the actual fare and advanced

booking;

7. On the utilization of services in hotels and similar

lodging establishments, restaurants and recreation

centers;

8. On admission fees charges by theatres, cinema

houses and concert halls, circuses, leisure a The BIR issued assessment notices to Kudos Metal

Corporation beyond the three-year prescriptive period,

but claims that the period was extended by the two

waivers executed by its accountant. The Supreme Court

ruled that the waivers are defective and hence, the

assessments issued by the BIR are void. When receiving a notice of audit from the BIR, don’t fret.

Worrying upon the receipt of a notice of audit from the BIR will result in unnecessary nervous tension. As we know, the notice of audit or a letter of authority (LOA) only means that the taxpayer’s case will be reviewed by BIR examiners. While it is true that a notice of audit means future work on the part of taxpayers, there are no tax findings yet at such time. So, worrying too much at the LOA stage is premature.

For all we know, the BIR’s audit may turn up only minimal findings. Unless you are a tax evader, there should be no reason to fear BIR examiners.

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

#itanongmunakaymaestro

#totoongtaxspecialista

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill, accomplish BIR Form 1901, 1902, 1903, 1905, 1601C, 1601EQ, 1601FQ, 1603, 1701Q, 1701, 1702Q, 1702, 2551Q, 2550M, 2550Q, 2000, 2200, 1800, 1801, tax returns.

How to prepare valid protest for BIR letter of authority, subpoena duces tecum, checklist of requirements, complaint affidavit, notice of discrepancies, preliminary final assessment notice, formal letter of demand, a final decision on disputed assessment.

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

#itanongmunakayMaestro #emelinotmaestro #totoongTaxSpecialista #BIRletterofauthority #BIRnoticeofdiscrepancies

Together we REDUCE an assessment United we STOP the harassment

Support our advocacy by joining our YouTube Membership and get access to exclusive perks!

https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

Contact us at:

0908 880 7568 Len

0917 307 1356 Onia

0917 307 1316 Guia

Visit our websites:

https://emelinotmaestro.com/

https://kataxpayer.com/

Like, Subscribe, and Follow us on Social Media:

TaxSpecialista YouTube Channel: https://www.youtube.com/c/EmelinoTMaestro

Kataxpayer Facebook Fan Page: https://www.facebook.com/KATAXPAYER

TaxSpecialista Discord Server: https://discord.gg/GPAyVD5ATu

Support our campaign for the passage and ratification of the General Tax Amnesty. Sign and share this petition now! http://chng.it/Mp7f4z5z

Taxpayer Ako! Movement (Application Form)

Click this now https://forms.gle/dRVJ8es3hrcH7UEv6

Tax Bookkeeper (Application Form)

Click this https://forms.gle/tbb46Wm2sDmjiBDu5

#ItanongMunaKayMaestro

#TotoongTaxSpecialista

#EmelinoTMaestro

#Kataxpayer

#EaseOfPayingTaxes

#BIRLetterOfAuthority

#BIRNoticeOfDiscrepancy

#BIRPreliminaryAssessmentNotice

#BIRFormalLetterOfDemand

#BIRAssessmentNotice

#BIRSupoenaDucesTecum

#BIRFinalDecisionOnDisputedAssessment

This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill up accomplish submit prepare file stor retrieve What is tax return BIR Form 1901 1902 1903 1905 1601C 1601EQ 1601FQ 1603 1701Q 1701 1702Q 1702 2551Q 2550M 2550Q 2000 2200 1800 1801

How to answer resolve prepare comply reduce protest compromise settle correct agree request appeal reinvestigate reconsider negotiate decrease abate petition BIR letter of authority subpoena duces tecum checklist of requirements complaint affidavit notice of discrepancy preliminary final assessment notice formal letter of demand a final decision on disputed assessment NOD PAN FLD FAN FDDA penalty open case business closure failure to file submit BIR form tax return VAT nonVAT sales invoice official receipt VAT summary list of sales purchases importation POS daily sales report failure to supply complete information data late registration books of accounts vAT nonVAT invoice official receipt business failure to pay settle deficiency income tax value-added tax percentage tax documentary stamp tax excise tax withholding tax estate tax

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy importation

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer-generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

How to register update apply activate transfer inactivate renew correct terminate cancel change amend BIR certificate of registration TIN taxpayer identification number tax return BIR Form VAT cooperative corporation single sole proprietorship business employee partnership joint venture estate trust employer address civil status RDO books of accounts commercial invoice VAT nonVAt sales invoice official receipt purchase invoice receipt

How to accounting bookkeep interpret record report explain support VAT nonVAT gross income revenue receipts sales deductible non-deductible expenses capital regular assets goods properties personal commercial bank loans liability cost of sale service goods manufactured sold active passive income bank deposit withdrawal professional fee rental lease depreciation advertising compensation wages allowances de minimis fringe benefits SSS PHIC HDMF third party information insurance optional standard deduction interest research and development taxes license transportation travel government certification local government taxes ordinary allowable itemized deduction non-taxable income subject to final tax vat exempt regular special sale purchase returns allowances discounts

2021 Notice of Discrepancy Part 1 Understanding its ill or beneficial effects application of reliefs

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

#itanongmunakaymaestro

#totoongtaxspecialista

#emelinotmaestro

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill, accomplish BIR Form 1901, 1902, 1903, 1905, 1601C, 1601EQ, 1601FQ, 1603, 1701Q, 1701, 1702Q, 1702, 2551Q, 2550M, 2550Q, 2000, 2200, 1800, 1801, tax returns.

How to prepare valid protest for BIR letter of authority, subpoena duces tecum, checklist of requirements, complaint affidavit, notice of discrepancies, preliminary final assessment notice, formal letter of demand, a final decision on disputed assessment.

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

#itanongmunakayMaestro #totoongTaxSpecialista #emelinotmaestro #2021noticeofdiscrepancy #2021BIRletterofauthority #2021BIRdeficiencytaxassessment

We should understand the ill effects on not-knowing the effects on life and livelihood of a COMMON TAXPAYER... Help others to understand the NOD immediately.

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill, accomplish BIR Form 1901, 1902, 1903, 1905, 1601C, 1601EQ, 1601FQ, 1603, 1701Q, 1701, 1702Q, 1702, 2551Q, 255)M, 2550Q, 2000, 2200, 1800, 1801, tax returns.

How to prepare valid protest for BIR letter of authority, subpoena duces tecum, checklist of requirements, complaint affidavit, notice of discrepancies, preliminary final assessment notice, formal letter of demand, a final decision on disputed assessment.

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

#itanongmunakaymaestro

#totoongtaxspecialista

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

How to fill, accomplish BIR Form 1901, 1902, 1903, 1905, 1601C, 1601EQ, 1601FQ, 1603, 1701Q, 1701, 1702Q, 1702, 2551Q, 2550M, 2550Q, 2000, 2200, 1800, 1801, tax returns.

How to prepare valid protest for BIR letter of authority, subpoena duces tecum, checklist of requirements, complaint affidavit, notice of discrepancies, preliminary final assessment notice, formal letter of demand, a final decision on disputed assessment.

How to make accounting entries in the BIR registered books of accounts, computerised books of accounts accounting system VAT withholding income tax accounting entries

How to prepare a balance sheet income profit and loss cash flow retained earnings notes to financial statement RAMO 1-2020

Differences between individual non-individual partnership corporation joint venture one person corporation OPC cooperative income tax return delinquency taxes

What is how to compute minimum corporate income tax net operating loss carry over (NOLCO) passive active income best tax saving scheme devise approach strategy

Statement of management responsibility tax credit refund percentage tax VAT exempt Zero rated VAT PEZA BOI registered

How to reduce decrease lower zero out cancel surcharge interest compromise penalty annual registration fee

How to use computer generated third party information data warehouse mission order POS surveillance tax mapping oplan kandado mission order to taxpayers' advantage benefit VAT invoice Ease of paying taxes

Call 09173071316 or 09088807568

Open cases

In 2002, I opened a small business – miniscule really – that my father funded. An Internet shop along Katipunan Avenue that I managed with a friend. We were right beside another Internet shop, and down the street there were two more Internet cafes. Which is to say we barely broke even every month.

In 2004, we closed shop. I was too young, too careless, to know that I needed to close the shop’s books with the BIR, or else they would continued to charge me for not filing taxes every month.

You got it: every month.

Fast forward to 2015, a little over a decade since. I get work that will pay me P60k, a major feat really for a freelancer. Before this, I was never asked for a receipt by the places I write for, and they’d tell me they were filing my taxes for me. Withholding tax, my payslips said. I had no reason to disbelieve it.

In the past, I wouldn’t even earn enough to be required to file my taxes. In the past, which is to say before this version of the BIR.

Getting back into the grid didn’t seem like a big deal to me – even as I believe it to be an injustice for freelancers like me who were being treated as “self-employed.”

When we checked if I could get myself those receipts, the BIR revealed that I had open cases from that old business, and since 2005, they have been charging me monthly for failing to close my books with their office.

Which means they are charging me now, for a business that closed down 11 years ago. They are charging me for a business that has been closed down since 2004, which has a business address that has ceased to exist – the building was sold and destroyed in 2006.

The BIR is charging me P60 thousand pesos as of June 2015. Exactly the same amount I’m supposed to get if and when I finally get my BIR receipt for this rare editing gig.

It’s like I’m earning this much for the first time, after a decade of blood sweat tears as freelancer, and all of it will go the BIR.

To set the context, let’s revisit the Philippine tax audit process. It starts with the issuance of a Letter of Authority (LoA), allowing the BIR to conduct the audit. After the examination of the taxpayer’s records, the BIR will issue a Notice for Informal Conference (NIC), containing preliminary findings and the schedule for the conference with the revenue officers.

If the BIR does not find the explanations or documents submitted at the conference satisfactory, a Preliminary Assessment Notice (PAN) will be issued. The taxpayer will have 15 days to reply. If the findings remain unresolved, the BIR will issue a Formal Assessment Notice and a Formal Letter of Demand (FAN/FLD). Within 30 days, the taxpayer must file for reconsideration or reinvestigation as a form of protest. Otherwise, the assessment shall become final and executory. In case of a request for reinvestigation, the taxpayer is given an additional 60 days from the filing of the protest to submit supporting documents.

The BIR then has 180 days to decide on the protest and issue a Final Decision on Disputed Assessment (FDDA). If the taxpayer disagrees with the FDDA, an appeal may be filed with the Commissioner of Internal Revenue (CIR) or the Court of Tax Appeals (CTA) within 30 days.

Under RR 11-2020, the deadline for filing of the following documents or correspondences which fall due within the quarantine period starting 16 March 2020 until 30 days from the lifting of the ECQ, shall be extended for “30 days from the date of the lifting of the quarantine:”

protests/replies to the NIC, PAN, and FAN/FLD;

submission of relevant supporting documents for requests for reinvestigation;

appeal to the CIR on assessments which have reached the FDDA stage; and

other similar letters and correspondences with due dates.

While not explicitly mentioned, the deadline for submission of documents in response to an LoA may also be extended under Item No. 4 above. Effectively, all tax investigation deadlines at the BIR are extended — from replying to the LoA to appeals to the CIR.

Initially, the BIR under RMC 31-2020 only extended the deadlines to filings/responses falling due within the ECQ. However, RR 11-2020 has expanded this to cover taxpayers whose deadline to respond falls due within 30 days from the date of the lifting of the ECQ.

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

We can all avoid altogether the BIR letter of authority checklist of audit requirements subpoena duces tecum assessment notice formal letter of demand final decision on disputed assessment oplan kandado tax mapping tax compliance verification drive professional fee bookkeeper accountant CPA lawyers criminal prosecution DOJ subpoena complaint affidavit Section 266, Section 255, Section 267, Section 264 Use electronic books of accounts with electronic official receipt electronic invoicing RESIBO.PH katapatph.com emelinotmaestro.com kataxpayer.com

Duly acknowledge his receipt of the appropriate Letter of Authority upon its presentation by the Revenue Officer authorized to conduct the audit by affixing in the Letter of Authority the name of the recipient and the date of receipt. Hereunder is an overview of how tax assessment in the Philippines or BIR tax audit operates in the Philippines constituting how due process is served upon taxpayers involved in BIR tax investigation. Letter of Authority (LOA). Because there are a lot of BIR Revenue Officers, a Letter of Authority (LOA) is normally issued to When does audit begin? The audit process begins with the issuance and receipt of an electronic Letter of Authority (eLA or LOA) to a taxpayer who has been selected for audit. The checklist of documentary requirements must be discussed and clarified with the BIR as not all documents are applicable and Taxation is the lifeblood of the government. Through the collected taxes, the government is able to fund the increasing need of its people for infrastructure, education, health, etc. The Bureau of Internal Revenue (BIR) is the Philippine government's largest revenue collecting arm. For instance, a report on the results of a tax investigation must be submitted not later than 180 days (for non-Large Taxpayers) or 240 days (for Large Taxpayers) from the issuance of the Letter of Authority. With these new rules and the BIR's increasing revenue targets, one could expect a BIR audit sooner Even before the BIR issues the PAN, or better yet, even before the taxpayer receives a Letter of Authority for a BIR audit, the taxpayer will do well to review his records to ensure that the declarations in his tax returns are reconciled with those disclosed in his financial statements. Period to serve Letters of Authority. Here cometh the taxman. With the reported revenue collection falling below target and with the lifting of the suspension on tax audits, the Bureau of Internal Revenue (BIR) is expected to step up its investigations and assessments on taxpayers. Letter of Authority (LA). This is the usual letter given to start BIR audit. The Letter of Authority is an official document that authorizes BIR personnel to examine a Taxpayer's book of accounts and other records in order to know the Taxpayer's correct tax liabilities. • Memorandum of Assignment. It is either the assignment of your But do agents of the BIR have authority to examine records of taxpayers at will and/or without limitation? The Supreme Court in GR 178697, November 17, 2010, said there must be a grant of authority before any officer can conduct an examination or assessment. Equally important is ... given in the Letter of Authority (LOA) As a result, more taxpayers are receiving Letters of Authority and being subjected to various forms of BIR examination. ... one was in the given address, the BIR left the other copy of the letter notice in the mail box and served the other copy through registered mail which was evidenced by a registry receipt.On an administrative level, the basic standard operating procedure is for the BIR to issue a Letter of Authority to the taxpayer with the appointment of revenue officers who will conduct the audit and examination. The taxpayer is requested to submit documents which the revenue officers would need to conduct investigation. Within, beyond scope of Letter of Authority. Due to the number of assessments and tax-audit investigations being cancelled on account of the taxpayers' availment of the tax-amnesty program, the Bureau of Internal Revenue (BIR) began issuing new letters of authority (LA) for the examination of taxpayers' books of accounts Under Revenue Memorandum Order (RMO) No. 43-90, all audits/investigations should be conducted under a Letter of Authority (LOA). In relation to this, Revenue Audit Memorandum Order (RAMO) No. 01-00 requires that the LOA be served or presented to the taxpayer within 30 days from its date of issue.To start the audit, the BIR selects a taxpayer and requests documents from him through a the letter of authority (LOA) or a tax verification notice (TVN). The LOA or the TVN is sent to the taxpayer to inform him of the audit process. As a general rule, a taxpayer can only be audited once for a taxable year.

Even if you have little Knowhow in Taxation, Don't Worry because ETM will Train you to be a highly sought and paid Tax Bookkeeper, Letter of Authority Specialist, Subpoena Duces Tecum Specialist or Benchmarking Specialist. Clients all over the Philippines will search and get you through the Apps (TaxMapping.com). For complete package, watch the video below and share its link to others.

(Here is the deal)

Refer 15 friends, relatives and business associates to register, pay and attend (RPA) the November event. ETM will train you free of charge for the course 'LETTER OF AUTHORITY SPECIALIST' (Affiliate Program is now accessible @ EmelinoTMaestro.com). Study Now Pay ETM Later Plan is now available. Its terms and conditions are available upon request.

Petitioner argues that the deductions from its gross income for the taxable year 1997 were duly substantiated with sufficient evidence in accordance with Section 34(A)(1 )(b) of the National Internal Revenue Code of 1997, to wit: "(b) Substantiation Requirements - no deduction from gross income shall be allowed under Subsection (A) hereof unless the taxpayer shall substantiate with sufficient evidence, such as official receipts or other adequate records: (i) the amount of the expense being deducted, and (ii) the direct connection or relation of the expense being deducted to the development, management, operation and/or conduct of the trade, business or profession of the taxpayer." It further asserts that based on the afore-quoted provision of law, the legislature did not intend to limit the manner of substantiating deductions through official receipts or invoices but also by means of other adequate records. To bolster its stance, petitioner cited the case of Paper Industries Corporation vs. Commissioner of Internal Revenue\ where this Court, sitting as a Division, set the basic principles governing deductions, to wit:1. The taxpayer seeking a deduction must point to some specific provision of the statute in which that deduction is authorized; 2. He must be able to prove that he is entitled to the deduction which the law allows; and 3. Adequate records should be kept to support deductions. Petitioner contends that the documents adduced in support of the deductions for ordinary and necessary expenses are more than sufficient to substantiate its claimed deductions. The cash vouchers submitted in evidence by petitioner were accompanied by other documents like certifications, lease contracts, showing beyond doubt that the deductions claimed by petitioner are bona fide business expenses incurred in the conduct of its trade or business. In addition to the aforesaid documents, petitioner avers that the expenses claimed by petitioner as deductions were subjected to the applicable expanded withholding taxes duly remitted to the Bureau of Internal Revenue. These certificates of remittance give credence if not prove beyond doubt that the questioned/disallowed deductions are bona fide expenses of petitioner. Furthermore, petitioner argues that in a number of cases, this Court allowed deductions for ordinary and necessary business expenses on the basis of cash vouchers issued by the taxpayer and/or certifications issued by the payee evidencing receipt of interest on a loan as well as agreements relating to the imposition of interest.

Retail tax accounting non vat bookkeeping vat registered resibo.ph electronic invoicing accpt intern

TEXT, CALL PHILIPPINES

0917 307 1356 Onia

0917 307 1316 Guia

0908 880 7568 Len

FB https://www.facebook.com/KATAXPAYER

DISCORD https://discord.gg/re5QC9Wq

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

This video explained how you may extricate yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.

Together we REDUCE an assessment United we STOP the harassment

Support our advocacy by joining our YouTube Membership and get access to exclusive perks!

https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

DEPOSIT YOUR DONATIONS

Emelino T Maestro

Bank of the Philippines Islands

Savings Account No. 1969-0986-91

Contact us at:

0908 880 7568 Len

0917 307 1356 Onia

0917 307 1316 Guia

Visit our websites:

https://emelinotmaestro.com/

https://kataxpayer.com/

Like, Subscribe, and Follow us on Social Media:

TaxSpecialista YouTube Channel: https://www.youtube.com/c/EmelinoTMaestro

Kataxpayer Facebook Fan Page: https://www.facebook.com/KATAXPAYER

TaxSpecialista Discord Server: https://discord.gg/GPAyVD5ATu

Support our campaign for the passage and ratification of the General Tax Amnesty. Sign and share this petition now! http://chng.it/Mp7f4z5z

Taxpayer Ako! Movement (Application Form)

Click this now https://forms.gle/dRVJ8es3hrcH7UEv6

Tax Bookkeeper (Application Form)

Click this https://forms.gle/tbb46Wm2sDmjiBDu5

#ItanongMunaKayMaestro

#TotoongTaxSpecialista

#EmelinoTMaestro

#Kataxpayer

#EaseOfPayingTaxes

#BIRLetterOfAuthority

#BIRNoticeOfDiscrepancy

#BIRPreliminaryAssessmentNotice

#BIRFormalLetterOfDemand

#BIRAssessmentNotice

#BIRSupoenaDucesTecum

#BIRFinalDecisionOnDisputedAssessment

This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously.