Aryel Narvasa

|Subscribers

Latest videos

Do you want to score TFL SERU Exam more than 90%?

Hello friends ! in this short video I gonna tell you about topographical skills assessment test UK that what happened when you Fail the TFL test.

there are two chances for the test.if you Fail after the second attempt you will have to re apply for the pco license and cost to more money.

thanks for watching and don't forget subscribe my channel

TFL test

Topographical Skills Assessment Test UK 2021

transport for London

TFL test 2021

if I fail the pco license test

Driver Behaviour. In this video we will cover driver's behaviour. This video have 2 parts.

Are you preparing for the Safety, Equality, and Regulatory Understanding (SERU) assessment as a PHV (Private Hire Vehicle) driver in London? You're in the right place! We're excited to introduce our comprehensive mock test designed to help you master the SERU requirement and ace your assessment.

Our mock test is the perfect tool for new applicants and those renewing their PHV driver licenses to assess their knowledge and readiness for the SERU requirement. Here's what you can expect from our mock test:

1. Comprehensive Coverage: Our mock test covers all the essential aspects of the SERU requirement, including driver obligations under the PHV (London) Act 1998, relevant regulations, obligations under the Equality Act 2010, policies and guidance by Transport for London (TfL), and much more.

2. Realistic Experience: We've designed the mock test to replicate the actual SERU assessment as closely as possible. This means you'll encounter multiple-choice questions and sentence completion tasks, just like the real thing.

3. In-Depth Analysis: After completing the mock test, you'll receive detailed feedback and explanations for each question, helping you understand the correct answers and where you might need improvement.

4. Convenient Practice: Access the mock test online from the comfort of your own home. Practice at your own pace and convenience, ensuring you're fully prepared for the SERU assessment.

5. Boost Your Confidence: With every question you answer correctly, your confidence will grow, and you'll be better equipped to demonstrate your knowledge during the official assessment.

Don't leave your SERU assessment to chance. Our mock test is an invaluable resource to help you prepare effectively, ensuring you meet the safety, equality, and regulatory standards required to be a successful PHV driver in London.

Take the first step toward acing your SERU assessment by practicing with our mock test. Get ready to impress TfL with your knowledge and commitment to safety and equality. Start your journey today and feel confident in your ability to meet the SERU requirement head-on. Good luck!

seru mock test free

seru exam questions and answers

seru mock test

seru test

tfl seru

seru mock test pdf

Seru assessment login

seru book

tfl seru mock test free

Seru tfl reviews

Seru tfl questions

Seru tfl

Seru tfl assessment questions

Seru tfl assessment

tfl seru handbook

seru exam questions and answers

seru mock test pdf

Seru test preparation pdf free

Seru test preparation pdf

Seru test preparation free

Seru test preparation book

seru mock test online free

seru test app

Seru practice youtube video tfl

Seru practice youtube video reddit

Seru practice youtube video free

seru exam questions and answers

seru mock test

seru mock test practice free

seru test practice

seru assessment questions

TFL, Transportforlondon, Taxidrivers, Phvdrivers, Seru, Serutest, Privatehiredrivers, SERUTEST, Tfltest, Viral, Safeguardingassessment, Londontransport, Mayoroflondon, Privatehirelicence

tfl topographical assessment route planning questions, route planning mock test test, real route planning exam questions, sa pco, tfl test, tfl topographical test 2023, tfl pco test, tfl topographical test questions, tfl topographical test training, tfl topographical test route planning, uber pco test, topographical test sa pco, London phv driver handbook test, seru assessment handbook test, seru booklet

#tfl

#seru

#phvtuber

#dvla

#taxi

#taxidriver

#drivinglicence

#cab

#londonreal

#london

#phvdriver

#assessment

#mocktest

#mock

#minicab

#privatehire

#londondriver

#uber

#bolt

#Seruassessmenttfl

#serutestbooklet

#serutestapp

#serutesttfl

#serutestquestions

#serutestpractice

#serutestfillintheblanks

#serutest2023

#serutestpco

#serutestpassmark

#serutesttflhowmanyquestions

#serutestmock

#serutesttflhandbook

#serutesttfl2023

#serutestsamplequestions

#phvdriverhandbook

#serumocktest

#seruexam

#serupracticetest

#seruonlinecourse

#serutraining

#seruquiz

#serutfl

#seruquestions

#pakistan

#taxidriver

#cab

#travel

#taxiservice

#cars

#driver

#airport

#taxicab

#taxiservices

#taxilife

#transportation

#airporttaxi

#transportforlondon

#serutestbooklet

#serutestapp

#serutesttfl

#serutestquestions

#serutestpractice

#serutestfillintheblanks

#serutest2023

#serutestpassmark

#serutesttflhowmanyquestions

#serutestmock

#serutesttflhandboo

#serutesttfl2023

#serutestsamplequestions

#phvdriverhandbook

#serumocktest

#seruexam

#serupracticetest

#seruonlinecourse

#serutraining

#seruquiz

#serutfl

#seruquestions

TfL SERU Book 2023 in Audio / PHV Driver Handbook / Section 7: Safer Driving

In this video, we're sharing the TfL SERU Book 2023 in audio and the PHV Driver Handbook section 7: Safer Driving. This video is essential for anyone who wants to learn more about driving in London.

Whether you're a new driver or a seasoned one, this video is a must-watch! We'll be discussing everything from using the TfL SERU Book 2023 in audio to safe driving techniques in Section 7: Safer Driving. By the end of this video, you'll have everything you need to know to drive safely in London!

TfL SERU Book 2023 in Audio / PHV Driver Handbook / Section 7: Safer Driving

TfL SERU Book 2023 in Audio / PHV Driver Handbook / Section 7: Safer Driving

TFL SERU AUDIO BOOK,TfL SERU Book 2023 in Audio,PHV Driver Handbook,TfL SERU Book 2023,London PHV Driver Licensing,Audio Book,PCO License,PHV Regulations,PHV Safety,Licensing Requirements,Section 2 : Licensing Requirements for PHVs,Licensing Requirements for PHVs,seru audiobook,seru audio book,tfl seru assessment,tfl seru book 2023 in audio,tfl seru audiobook

TFL SERU EXAM ONLINE PRACTICE | SECTION 1:

https://www.youtube.com/playli....st?list=PLiMhJDWj1IJ

TFL SERU AUDIO BOOK

https://www.youtube.com/playli....st?list=PLiMhJDWj1IJ

The Ultimate Audio Handbook for PHV Drivers: TfL SERU Book 2023.

Navigating London Streets with the TfL SERU Book 2023.

Mastering the Knowledge: A Guide to London PHV Driver Licensing.

The Importance of PHV Driver Training and Safety.

How to Obtain a PCO License and Maintain Compliance.

PHV Insurance: What You Need to Know.

Studying for Your PHV Exam: Tips and Tricks.

TfL SERU Book 2023: Section 1 Overview.

Understanding Licensing Requirements for London PHV Drivers.

The Responsibilities of a Private Hire Vehicle Driver.

PHV Driving Best Practices: Dos and Don'ts.

The Impact of PHV Regulations on London Transportation.

TfL SERU Book 2023: Your Guide to PHV Compliance.

PHV Driver Handbook: Section 1 FAQs.

Top Mistakes to Avoid as a PHV Driver.

Exploring London's Best PHV Driver Routes.

The Future of PHV Transportation in London.

Interview with a Successful PHV Driver: Tips and Advice.

PHV Driver Handbook vs Practice Test: Which is Better?.

TfL SERU Book 2023 Audio Review: What to Expect.

#TfLSERUBook2023 #PHVDriverHandbook #LondonPHVDriverLicensing #AudioBook #PrivateHireVehicle #TheKnowledge #PCOLicense #TransportforLondon #PHVRegulations #PHVSafety #PHVDiverResponsibilities #PHVDiverTraining #LondonStreets #LicensingRequirements #PHVInsurance #PHVLicensingProcess #PHVCompliance #PHVBestPractices #LondonTransportation #UKTransportation #PHVDiverTips #PHVDiverGuide #PHVExam #PHVTest #PHVReviews #seru #minicab #londondrivers

RELATED VIDEOS:

TFL SERU AUDIO BOOKLET:

1. Section 1: London PHV Driver Licensing: https://youtu.be/u0jMXlmARrE

2. Section 2 : Licensing Requirements for PHVs: https://youtu.be/-PojLV1iOjc

3. Section 3: Carrying out Private Hire Journeys: https://youtu.be/72mds_lFGHs

4. Section 4: Staying Safe: https://youtu.be/pHKIUMIDYuw

5. Section 5: Driver Behaviour: https://youtu.be/sDD-KtNdKGc

6. Section 6: Driving and Parking in London: https://youtu.be/4e58Mo3Xabg

7. Section 7: Safer Driving: https://youtu.be/_g-BkgtwaAs

8. Section 8: Being Aware of Equality and Disability: https://youtu.be/PBvwX_3g_u4

9. Section 9: Safeguarding Children and Adults at Risk: https://youtu.be/c9eIbh57UtE

10. Section 10: Ridesharing: https://youtu.be/8qD2dmEUdRY

TfL SERU Book 2023 in Audio : Full Playlist : https://www.youtube.com/playli....st?list=PLiMhJDWj1IJ

SERU and ELR training videos

Please subscribe to my channel for complete training video’s.

Like my Facebook page for all updates and information about SERU and ELR

https://www.facebook.com/profi....le.php?id=1000869828

Training centre in SOUTHALL (25 Featherstone Road UB2 5AB) Contact 07562991711 For Training #tfl #topographicaltest #tfltopographicaltest #pcolicence #uber Song: Ikson - Paradise (Vlog No Copyright Music) Music promoted by Vlog No Copyright Music. Video Link: https://www.youtube.com/watch?v=glMhD3EU46k&t=0s

Training centre in SOUTHALL (25 Featherstone Road UB2 5AB) Contact 07562991711 For Training #tfl #topographicaltest #tfltopographicaltest #pcolicence #uber Song: Ikson - Paradise (Vlog No Copyright Music) Music promoted by Vlog No Copyright Music. Video Link: https://www.youtube.com/watch?v=glMhD3EU46k&t=0s #topographical #seru #topography #tfltopographicalexam #topographical assessment #topographic #tflseru #newseru #no1pcotraining #pcolicence

TFL Topographical Test 2023 | Compass Point Questions, A to Z questions TFL Topographical test,

Visit our Website

https://bestpcotraining.co.uk

our packages List

https://bestpcotraining.co.uk/training-packages/

Please Text on WhatsApp 07432791059 for 121 Training

The SA PCO training is the best place to guide you through for PCO application and help you to pass the topographical tests for the first time. We start working in March 2019 and have a YouTube channel that got 1000 subscribe in less than 6 months. We put extremely helpful material to pass the topographical test and get an incredibly good response and many people passed only by watching these videos. Please check people’s feedback and comments on our YouTube channel which is called ‘The best PCO is training’. People are passing their topographical test in the first attempt with the help of our professional staff. We hope you enjoy our services as much as we enjoy offering them to you. If you have any questions or comments, please do not hesitate to contact us.

The SA PCO training is the best place to guide you through for PCO application and help you to pass the topographical tests for the first time. We start working in March 2019 and have a YouTube channel that got 1000 subscribe in less than 6 months. We put extremely helpful material to pass the topographical test and get an incredibly good response and many people passed only by watching these videos. Please check people’s feedback and comments on our YouTube channel which is called ‘The best PCO is training’. People are passing their topographical test in the first attempt with the help of our professional staff. We hope you enjoy our services as much as we enjoy offering them to you. If you have any questions or comments, please do not hesitate to contact us.

For more info please visit our website

TFL PCO Real Exam question. Tricky Neasden Junction explained. Another great Tip is also explained in this video that will help you to draw most of the routes correctly. Clear your concepts & ensure success!

For Free MCQ Mock Test visit https://forms.gle/MsUDnwXoeYhtoe7o8

For 1 on 1 Training in Eng/Urdu/Hindi @ Lowest price, please contact 07462134959

আজ রাত ১০টায়

SERU EXAM, A2, B1 & Food Safety

Training & Life skill🔺TV3 Bangla

Tuesday, 10 May 2022 at 10 PM

Instructor:

Abdul Haque Chowdhury

Host:

Nashit Rahman

ফোনে অথবা ইউটিউবে প্রশ্ন করুন:

☎️ Studio: 01227392972

We have finally decided to join YouTube ( 07562991711)

We've been doing class room training and online training for over 2 years now @ our SOUTHALL office. (25 Featherstone Road UB2 5AB)

Contact 07562991711 For Training

#tfl tfl #tfltopographical #topographicaltest #uber #pcolicence #youtubeislife #subscriber #youtubeguru #youtubecontent #newvideo #subscribers #seru #serutest #youtubevideo

#youtub #youtuber #youtubevideos

Bliss by Luke Bergs | https://soundcloud.com/bergscloud/ Creative Commons - Attribution-ShareAlike 3.0 Unported https://creativecommons.org/licenses/by-sa/3.0/ Music promoted by https://www.chosic.com/free-music/all/

This video is about Driver’s PHV Handbook Seru Section 03. In this video you will learn about Seru Assessment Transport For London Questions and Answers.

Hopefully it will help you to pass your “Seru Assessment TFL”.

I hope you like the video, if you do so please don’t forget to hit like and share.

If have any questions please feel free to reach out

Thank you

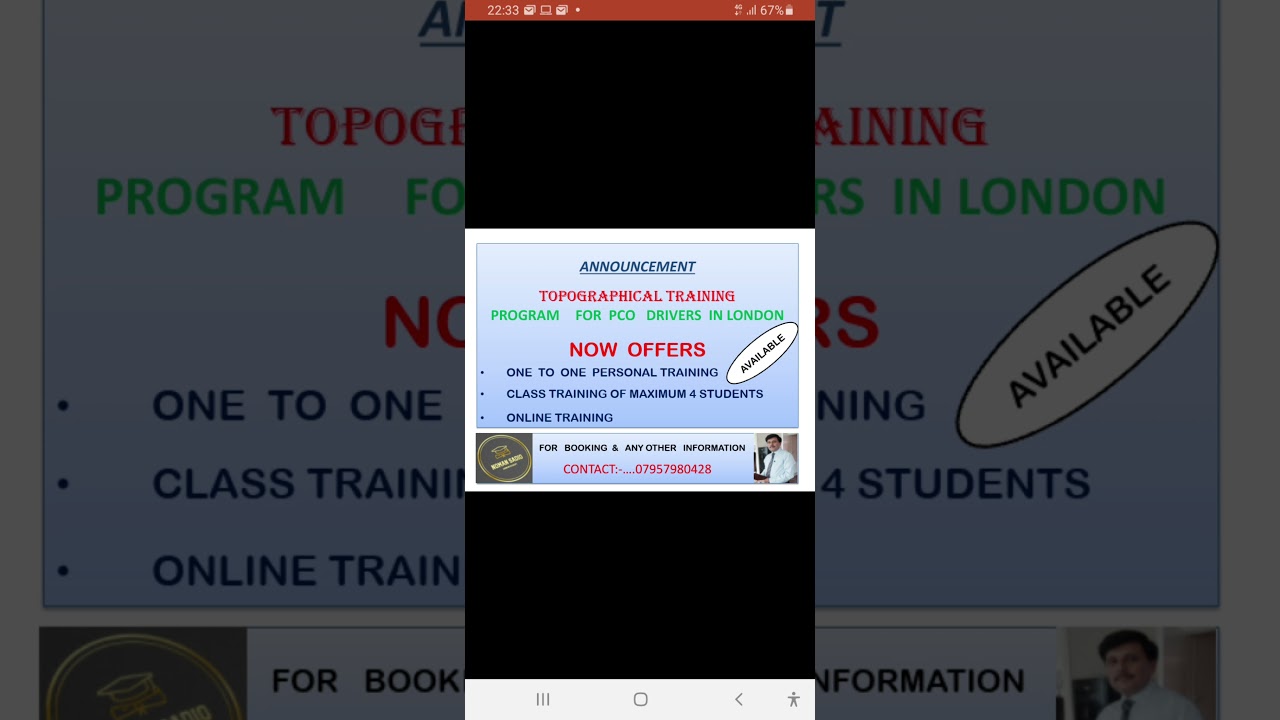

TOPOGRAPHICAL TRAINING PROGRAM FOR PCO/PHV DRIVERS IN LONDON. IMP. ANNOUNCEMENT REGARDING TRAINING.

TOPOGRAPHICAL TRAINING

PROGRAM FOR PCO DRIVERS IN LONDON

NOW OFFERS

1...ONE TO ONE PERSONAL TRAINING

2...CLASS TRAINING OF MAXIMUM 4 STUDENTS

3...ONLINE TRAINING

OUR TOPOGRAPHICAL TRAINING

PROGRAM FOR PCO DRIVERS IN LOND ON IS IN

ENGLISH LANGUAGE

BUT IN ADDITION TO THIS ,

WE JUST SUPPORT OUR STUDENTS IN URDU, PUNJABI AND HINDI LANGUAGES.

THANKS

Now I have started TFL TOPOGRAPHICAL TRAINING in my PERSONAL CAPACITY as well. I always work hard and try my Level best to train my students in such a way that they could pass their TOPOGRAPHICAL TEST in flying colours but I never Guarantee any of my students. We can not even Guarantee our next breathe. We could only try our level best . Our passing rate so for is 100% and most of our students got marks more than 75%.

It is always better to get one to one personal training and I am offering Full Topographical training along with online videos, quizzes and other training material. My Topographical training is fully in accordance with TFL Exam.

Just Contact.

AHMED NOMAN SADIQ

Cell No . +447957980428

+447404026479

#SHORTS

#tfl

#tflassessment

#BLACLWALLTUNNEL

#tfltest

#121training

#topographictraining

#misleadingconcepts

TFL topographical test 2021

TFL topographical test 2022

How to pass tfl topographic Assessment Test 2021.

How to pass tfl topographic Assessment Test 2022.

TFL Topographical Skills Assessment Test in the UK 2021,

TFL Topographical Skills Assessment Test in the UK 2022

MCQS section of worth 25 marks

TOPOGRAPHICAL ROUTES SECTION OF WORTH 75 MARKS

TOPOGRAPHICAL ROUTES PLANING

TOPOGRAPHICAL ROUTES DRAWING

TOPOGRAPHICAL MAPS

TOPOGRAPHIC MAPS

Topographical Skills Assessment Test 2021,

Topographical Skills Assessment Test 2022

Route planning questions

MOCK TEST

TOPOGRAPHICAL INTERACTIVE MAPS

TOPOGRAPHY

#NOMAN SADIQ

#AHMED

#AHMAD

AHMED NOMAN SADIQ

AHMAD NOMAN SADIQ

NOUMAN SADIQ

SIDDIQUE

NOUMAN

topographical skills test 2021 london

topographical skills test 2022 london

most direct route tfl

most direct route tfl topographical Assessment

#tfltest dartford

tfltest dartford

#tfltest blackwall tunnel

tfltest blackwall tunnel

ROTHERHITHE TUNNEL

#ROTHERHITHE TUNNEL

Hammersmith flyover

#Hammersmith flyover

#Hammersmith bridge

Hammersmith bridge

topographical training,tfl topographical test training,topographical,tfl topographical mock test,topographical test,tfl topographical assessment route planning questions,tfl topographical test,pco training,tfl topographical,no1 pco training,tfl topographical test route planning,tfl topographical test 2023,tfl topographical test questions,topographical test sa pco,topographical skills assessment test,tfl topographical test 2022,topographical training 2023

Visit our Website

https://bestpcotraining.co.uk

our packages List

https://bestpcotraining.co.uk/training-packages/

Please Text on WhatsApp 07432791059 for 121 Training

____________________________________

The SA PCO training is the best place to guide you through for PCO application and help you to pass the topographical tests for the first time. We start working in March 2019 and have a YouTube channel that got 1000 subscribe in less than 6 months. We put extremely helpful material to pass the topographical test and get an incredibly good response and many people passed only by watching these videos. Please check people’s feedback and comments on our YouTube channel which is called ‘SA PCO’. People are passing their topographical test in the first attempt with the help of our professional staff. We hope you enjoy our services as much as we enjoy offering them to you. If you have any questions or comments, please do not hesitate to contact us.

This video is just for Education Purpose.

Find out the when the deadline is for your TfL SERU assessment , what the timeline is and the process for the Speaking & Listening Test.

The SERU assessment is separate from the English language test and focuses on reading, writing, and understanding of PHV regulations.

If you've already submitted a certificate or qualification, you may not need to take the speaking and listening test. However, if you haven't, you'll need to take it.

The deadline for the assessment depends on when you got your PHV license, and I'll explain the different deadlines for each group.

TFL will send you a letter or email with the details and give you about one to three weeks to prepare. The test is 45 minutes long with 37 questions, and the pass mark is 60%. It's computer-based, so you only need a mouse.

I'll also provide resources to help you prepare, including mock tests and an online training course. Start preparing early and find your level to ensure success. Don't wait for the letter to arrive. Let's get started!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

20% Discount for SERU Online Training Course & Mock Tests

Code: NEWUSER

https://serupractice.com/all-courses/

-------------------------------------------------------------------------------------------------------------------------------------------------------------

#serutestbooklet, #serutestapp, #serutesttfl, #serutestquestions, #serutestpractice, #serutestfillintheblanks, #serutest2023, #serutestpco, #serutestpassmark, #serutesttflhowmanyquestions, #serutestmock, #serutesttflhandbook, #serutesttfl2023, #serutestsamplequestions

#phvdriverhandbook #serumocktest #seruexam #serupracticetest #seruonlinecourse #serutraining #seruquiz #serutfl #seruquestions

Hi Guys

in this video I gonna tell you about TFL topographical assessment 2021 tha How to cross Black wall Tunnel from southern and northern app

Topographical Skills Assessment Test UK 2021

TFL test uk

TFL Topographical test 2022/Real exam questions February 2022/Topographical Training

Please call 07554443935 for 121 training