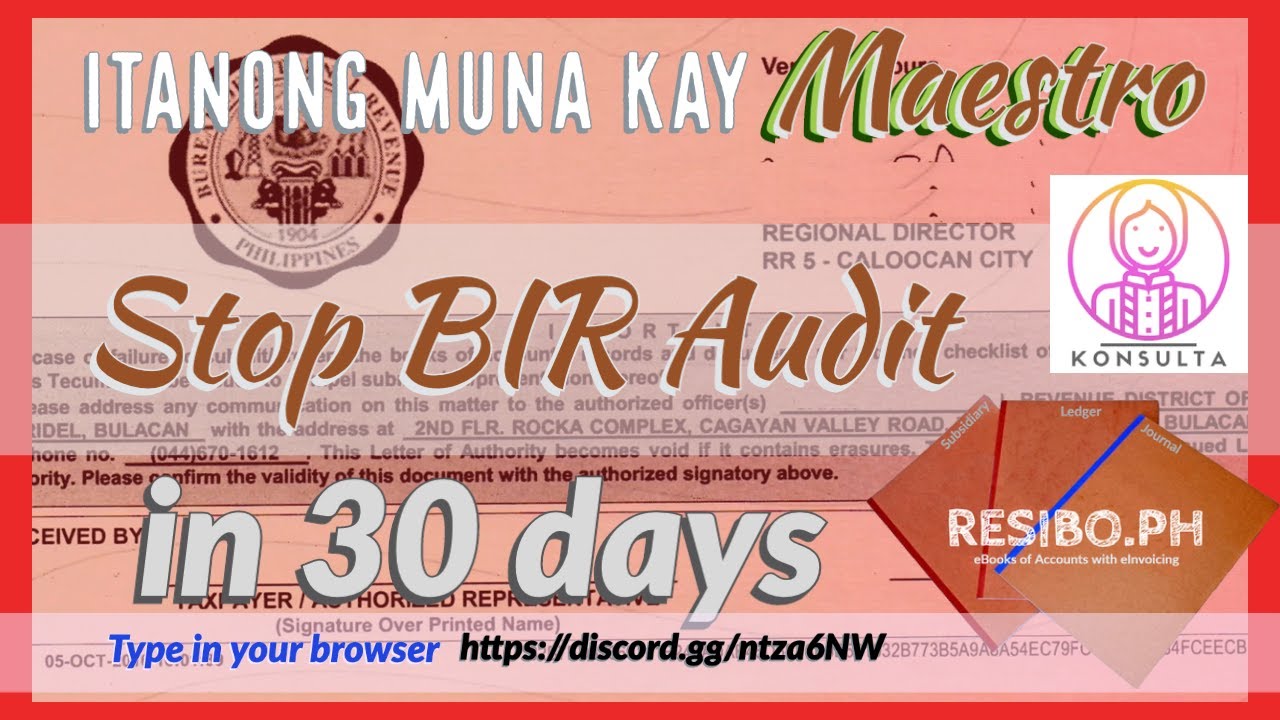

BIR Gameplan on Letter of Authority, Understanding it correctly, Emelino T Maestro

Call 09173071316 or 09088807568

Weathering the storm of BIR assessments | Grant Thorntonwww.grantthornton.com.ph › insights › lets-talk-tax

Jun 18, 2019 - Many taxpayers find themselves in a similar situation when receiving a Letter of Authority (LoA) issued by the Bureau of Internal (BIR) to ...

Overview of Handling BIR Tax Audit in the Philippines - Tax ...taxacctgcenter.ph › handling-bir-tax-audit-in-the-philip...

Because there are a lot of BIR Revenue Officers, a Letter of Authority (LOA) is normally issued to authorize specific Revenue Officer/s (RO) of a Tax Assessment ...

Letter of Authority (LOA): A Must-have for Tax Assessments in ...taxacctgcenter.ph › letter-of-authority-loa-a-must-have-...

... Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) No. 75-2018, which highlights the mandatory requirement of a Letter of Authority (LOA) ...

BIR LOA required for a valid assessment – The Manila Timeswww.manilatimes.net › business › columnists-business

Mar 12, 2020 - The proper issuance of a letter of authority (LOA), which is a written official authority issued by the Bureau of Internal Revenue (BIR) to its ...

No LOA, No Entry - KPMG Philippines - KPMG Internationalhome.kpmg › Home › Insights

Aug 7, 2018 - ... to a Letter of Authority (LOA) issued by the Revenue Regional Director, ... the prescribed procedure for protesting tax assessments of the BIR, ...

Serves you right! - KPMG Philippines - KPMG Internationalhome.kpmg › Home › Insights

Feb 18, 2020 - In May 2019, the BIR issued Revenue Memorandum Order (RMO) No. ... names were not indicated in the relevant Letter of Authority (LOA)].

Validity period of LOA | BusinessMirrorbusinessmirror.com.ph › Opinion › Column

May 2, 2018 - ... a letter of authority (LOA). Thus, as part of due process, the audit of the Bureau of Internal Revenue (BIR) commences with the issuance of an ...

BIR letter notices: Not enough for a tax assessment ...www.bworldonline.com › bir-letter-notices-not-enough...

Sep 10, 2018 - An LoA, on the other hand, is the authority given to the appropriate revenue officer assigned to perform assessment functions. The LoA empowers ...

You've visited this page 2 times. Last visit: 11/30/18

Page 1 ..,. REPUBLIC OF THE PHILIPPINES Court of Tax ...cta.judiciary.gov.ph › home › download

PDF

summons and other processes at Bureau of Internal Revenue ("BIR") ... assessment, a Letter of Authority ("LOA") must be issued to give authority to the ...

Understanding BIR Audit - ETM-Tax Agent Office, Inc.etmtaxagentoffice.com › understanding-bir-audit

Taxpayers receiving Letter of Authority (LoA or eLA) from the BIR may hold the impression of already losing the battle when it comes to paying the true and ...

(PDF) Taxpayer's Quick Guide in Disputing BIR Tax ...www.academia.edu › Taxpayers_Quick_Guide_in_Disput...

6 B. Letter of Authority (LOA) & BIR Fieldwork/Walkthrough . ... The BIR is not mandated to make an assessment relative to every return filed with it 8 4.

Tax Law: Difference between Letter Notice (LN) and Letter of ...www.boholchronicle.com.ph › 2019/10/12 › tax-law-di...

Oct 12, 2019 - In the L.N. the BIR informed the taxpayer of a 100% discrepancy between ... The reason: A Letter of Authority was not issued to the Revenue ...

#AskTheTaxWhiz: Further extension of deadlines, suspension ...www.rappler.com › business › 257817-ask-the-tax-whi...

Apr 13, 2020 - However, the BIR examiners who audited our books didn't believe us ... Before the lockdown, we already received a letter of authority (LOA) for ...

CTA voids BIR assessment for not serving letter of authority ...news.mb.com.ph › 2019/08/21 › cta-voids-bir-assessme...

Aug 21, 2019 - ... Bureau of Internal Revenues (BIR) deficiency tax assessment against a gas station owner due to the delayed serving of the Letter of Authority ...

How to Handle BIR Tax Assessments » Business Seminars by ...www.businesscoachphil.com › how-to-handle-bir-tax-a...

Letter of Authority (LA). This is the usual letter given to start BIR audit. The Letter of Authority is an official document that authorizes BIR personnel to examine a ...

How to Use BIR Letter of Authority to PREVENT ... - Eventbritewww.eventbrite.com › how-to-use-bir-letter-of-authorit...

Nov 19, 2019 - Eventbrite - RP Business Solutions Trust Fund presents How to Use BIR Letter of Authority to PREVENT ASSESSMENT - Tuesday, November ...

tax digest - Alas Oplas Co., CPAswww.alasoplascpas.com › Tax

PDF

What is e-Letters of Authority? New Rules for Issuance of TIN. Card and Transfer of Registration. VAT-Free Lifestyle for Senior. Citizens. BIR ISSUANCES.

X - LawPhillawphil.net › nov2016 › pdf › gr_196596_leonen

PDF

audit/investigation and issuance of letters of authority to audit, provides: C. Other policies for ... Letter of Authority, the only BIR officials authorized to issue and.