Start a Profitable CPA business and Earn millions of pesos from correct contracts and services

FREE BOOKS

🤍Manual For LoA Specialista Confidential

https://drive.google.com/file/....d/1yJ14gcOE75danVD7O

"25 FAQs Subpoena Duces Tecum. Coverage. Comprehension. Compliance."

https://drive.google.com/drive..../folders/1HHPrJVcNip

🤍HOW TO DONATE

https://drive.google.com/file/....d/19k-K0vz2J5X2T9pOy

SAMPLE CONTRACT FOR CPAs

https://drive.google.com/file/....d/1Wbj43xZ9snFHQQOS0

🤍IMPORTANT LEGAL NOTICE

Read our laws. Comprehend their meanings. Know their immediate and future effects. Apply them timely and consciously. This video explained how you may free yourself from tax ignorance and declare your independence and self-reliance today. For the record, ITS CONTENTS ARE FROM MY PERSONAL BELIEFS AND CONVICTION.

🤍WHO IS EMELINO T MAESTRO?

https://drive.google.com/file/....d/1Qw8VsHP1Nae3hKU-9

🤍HOW TO BOOK A CONFIDENTIAL TAX CONSULTATION

https://drive.google.com/file/....d/1MpZv1QW21OnYw3cBp

🤍HOW TO SETTLE TAXSPECIALISTA'S PROFESSIONAL FEE

https://drive.google.com/file/....d/1tOZRWwceLh5YqJgBf

🤍HOW TO BECOME A MEMBER OF TAXSPECIALISTA-COMMUNITY

https://www.youtube.com/channe....l/UCL-Q5vnEsv8tA_acF

Membership-Benefits

🤍https://youtu.be/DvpV9LHN8IU

The two most common problems with answers of CPAs who are beginning their own business are:

1. Incompleteness: New CPAs may not be familiar with all of the complex tax and accounting rules that apply to their clients, especially if they are working in a specialized industry. This can lead to incomplete or inaccurate answers.

2, Lack of confidence: New CPAs may lack the confidence to give definitive answers to their clients' questions. This can be due to their lack of experience, or simply because they are not sure of the correct answer.

Here are some tips for new CPAs to avoid these problems:

1. Do your research: Before giving an answer to a client, make sure to thoroughly research the topic. This may involve reading tax laws, accounting standards, and other relevant materials.

2. Consult with more experienced CPAs: If you are unsure of the answer to a client's question, don't be afraid to consult with a more experienced CPA. This is a great way to learn and ensure that you are giving your clients the best possible advice.

3. Be honest and upfront: If you don't know the answer to a client's question, be honest and upfront about it. Let the client know that you will research the topic and get back to them with an answer as soon as possible.

It is also important to remember that new CPAs are still learning. It is perfectly normal to make mistakes from time to time. The important thing is to learn from your mistakes and continue to improve your knowledge and skills.

🤍Basic Answers to Common Questions

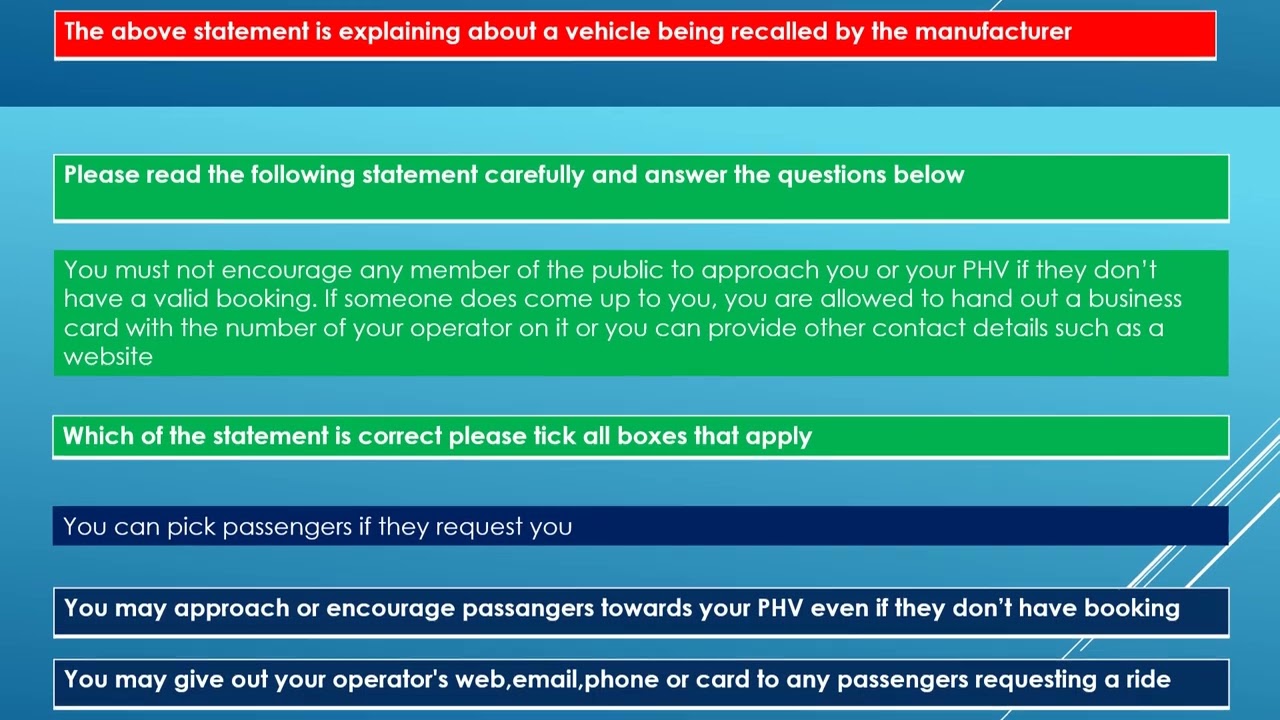

Q: What should I do if I receive a BIR Letter of Authority?

A: You should cooperate with the BIR revenue officers who will be conducting the audit or investigation. Provide them with all the requested documents and information. You may also want to consult with a tax advisor to help you with the process.

Q: What happens if I disagree with a deficiency assessment?

A: You have 30 days from the date you receive the deficiency assessment to file a protest with the BIR. The protest must be in writing and must state the reasons why you disagree with the assessment.

If the BIR does not approve your protest, you may file a petition with the Court of Tax Appeals.

Q: Can I pay a deficiency assessment in installments?

A: Yes, you may be able to pay a deficiency assessment in installments. However, you must request this from the BIR and the BIR must approve your request.

Other Common Questions

Q: What are the common grounds for deficiency assessments?

A: The common grounds for deficiency assessments include:

Failure to file a tax return

Filing an incorrect tax return

Failure to pay taxes on time

Underreporting of income

Overstating deductions

Q: Can I be audited even if I filed my tax return on time and paid all my taxes?

A: Yes, you can still be audited even if you filed your tax return on time and paid all your taxes. The BIR may select taxpayers for audit for a variety of reasons, such as random selection, industry-wide audits, or specific leads.

Q: What should I do to prepare for an audit?

A: The best way to prepare for an audit is to keep accurate and complete records of your income and expenses. You should also be familiar with the tax laws that apply to you.